Supercuts 2010 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2010 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

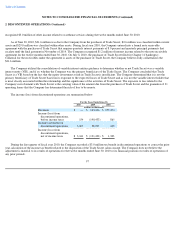

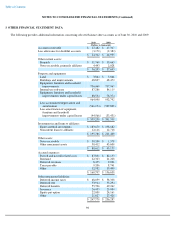

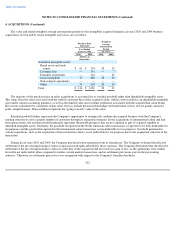

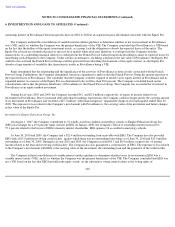

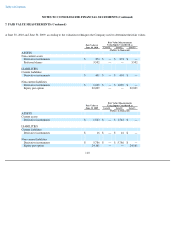

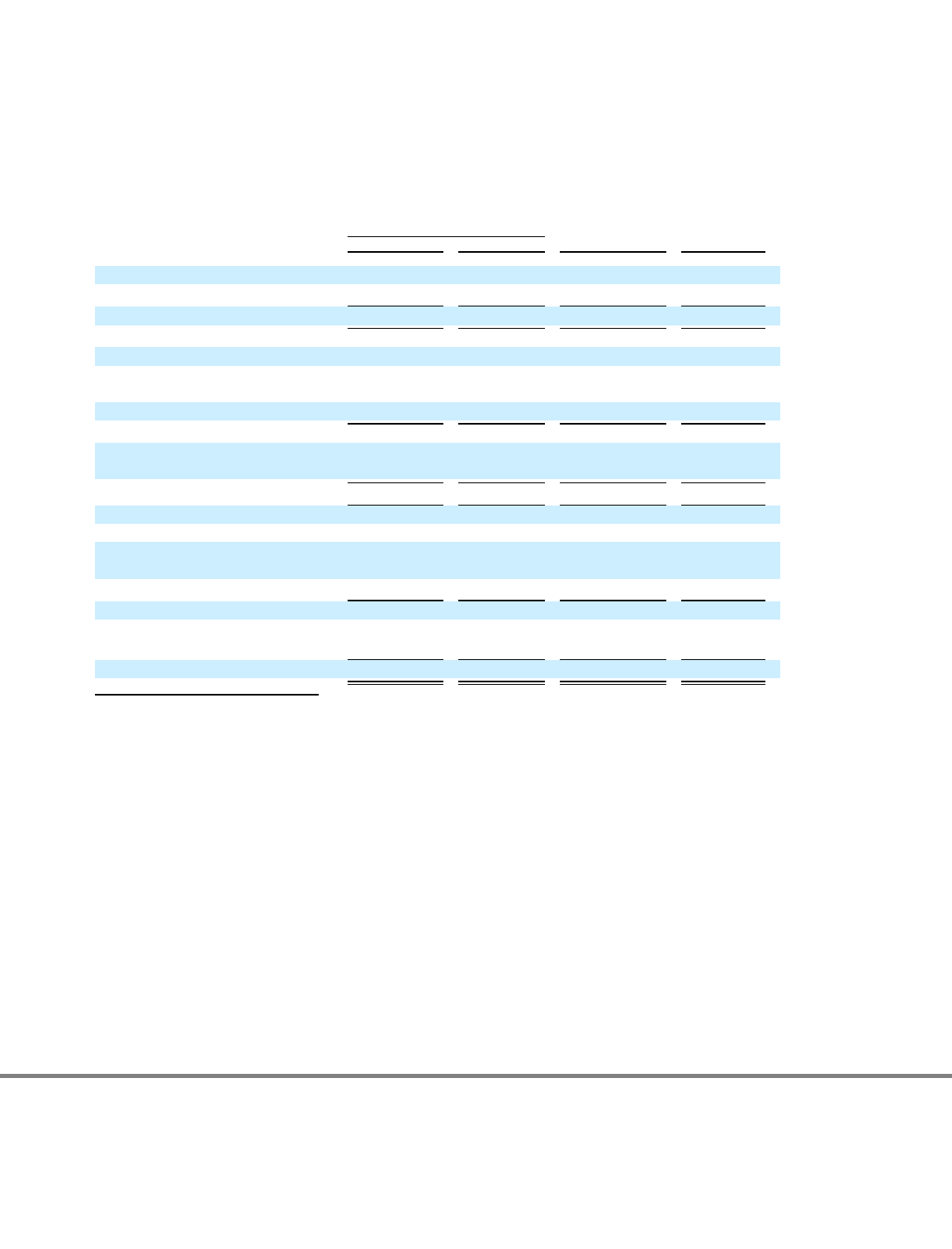

5. GOODWILL

The table below contains details related to the Company's recorded goodwill for the years ended June 30, 2010 and 2009 is as follows:

103

Salons

Hair Restoration

Centers

North America International Consolidated

(Dollars in thousands)

Gross goodwill at June 30, 2008

$

668,799

$

48,461

$

153,733

$

870,993

Accumulated impairment losses

—

—

—

—

Net goodwill at June 30, 2008

668,799

48,461

153,733

870,993

Goodwill acquired(3)

31,531

(1,255

)

536

30,812

Translation rate adjustments

(7,149

)

(5,545

)

(43

)

(12,737

)

Resolution to pre-acquisition

income tax contingency

—

—

(

4,859

)

(4,859

)

Goodwill impairment(2)(4)

(78,126

)

(41,661

)

—

(

119,787

)

Gross goodwill at June 30, 2009

693,181

41,661

149,367

884,209

Accumulated impairment losses(2)

(4)

(78,126

)

(41,661

)

—

(

119,787

)

Net goodwill at June 30, 2009

615,055

—

149,367

764,422

Goodwill acquired

2,581

—

—

2,581

Translation rate adjustments

4,250

—

13

4,263

Resolution to pre-acquisition

income tax contingency

—

—

1,000

1,000

Goodwill impairment(1)

(35,277

)

—

—

(

35,277

)

Gross goodwill at June 30, 2010

700,012

41,661

150,380

892,053

Accumulated impairment losses(1)

(2)(4)

(113,403

)

(41,661

)

—

(

155,064

)

Net goodwill at June 30, 2010

$

586,609

$

—

$

150,380

$

736,989

(1) As a result of the Company's annual impairment testing of goodwill during the three months ended March 31, 2010, a

$35.3 million impairment charge was recorded within continuing operations for the excess of the carrying value of

goodwill over the implied fair value of goodwill for the Regis salon concept.

(2) During the three months ended December 31, 2008 the fair value of the Company's stock declined such that it began

trading below book value per share. As a result of the Company's interim impairment test of goodwill during the three

months ended December 31, 2008, a $41.7 million impairment charge for the full carrying amount of goodwill within the

salon concepts in the United Kingdom.

(3) Goodwill acquired includes adjustments to prior year acquisitions, primarily representing the finalization of purchase

price allocations. For the twelve months ended June 30, 2009 the $1.3 million reduction to international goodwill related

to the settlement of the escrow account on an acquisition that closed in September 2007.

(4) As the proceeds the Company received from the sale of Trade Secret were negligible, the Company recognized a

$78.1 million goodwill impairment charge within discontinued operations during fiscal year 2009.