Supercuts 2010 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2010 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

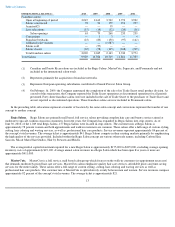

Organic Growth. The hair restoration centers' business model is driven by productive lead generation that ultimately produces

recurring customers. The primary marketing vehicle is direct response television in the form of infomercials that create leads into the

hair restoration centers' telemarketing center. Call center employees receive calls and schedule a consultation at a local hair restoration

company-owned or franchise center. At the consultation, sales consultants assess the needs of each individual client and educate them

on the hair restoration centers' suite of hair loss solutions.

The Company's long term outlook for organic expansion remains favorable due to several factors, including favorable industry

dynamics, addressing new market opportunities, menu expansion, developing new locations and new cross marketing initiatives. The

aging "baby boomer" population is expanding the number of individuals within the hair restoration centers' target market. This group of

individuals is entering their peak years of disposable income and has demonstrated a willingness to improve their physical appearance.

In 2003, Hair Club began marketing to women and changed its name to Hair Club for Men and Women. This represents a large

and relatively untapped market. Women now represent approximately 35 percent of new customers.

Currently, all locations offer hair systems, hair therapy and hair care products. Among the hair restoration centers' product

offerings are hair transplants. The hair restoration centers employ a hub and spoke strategy for hair transplants. As of June 30, 2010, 29

locations were equipped and staffed to perform the procedure. Currently, a total of 65 hair restoration centers offer this service to their

customers. The Company plans to add the capability to conduct hair transplants to more centers in future periods.

Company-owned-and franchise hair restoration centers are located in markets representing 74 percent of all U.S. television (TV)

households. The Company's hair restoration centers advertise on cable TV to over 85 million households. There is an opportunity to add

a limited number of new centers in under penetrated markets.

Hair Restoration Acquisition Growth. The Company plans to supplement organic growth with opportunistic acquisition

activity. The hair restoration industry is comprised of a highly-fragmented group of 4,000 locations. This landscape provides an

opportunity for consolidation. Given the existing coverage of Hair Club locations, it is anticipated that transactions may involve the

acquisition of customer lists, rather than physical locations.

Affiliated Ownership Interests:

The Company maintains ownership interests in salons and beauty schools. The primary ownership interests are in Provalliance, EEG and

Hair Club for Men, Ltd., which are accounted for as equity method investments.

The Company maintains a 30.0 percent ownership interest in Provalliance. The fiscal year 2008 merger of the operations of the European

operating subsidiaries with the Franck Provost Salon Group created a newly formed entity, Provalliance. The Franck Provost Salon Group

management structure has a proven platform to build and acquire company-owned stores as well as a strong franchise operating group that is

positioned for expansion.

The Company maintains a 55.1 percent ownership interest in EEG. Contributing the Company's beauty schools in fiscal year 2008 to EEG

leverages EEG's management expertise, while enabling the Company to maintain a vested interest in the highly profitable beauty school

industry.

The Company maintains a 50.0 percent ownership in Hair Club for Men, Ltd. Hair Club for Men, Ltd. operates Hair Club centers in

Illinois and Wisconsin.

20