Supercuts 2010 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2010 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

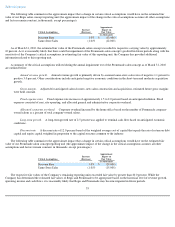

consumers. Our salon operations are organized to be managed based on geographical location. Our North American salon operations include

9,525 salons, including 2,020 franchise salons, operating in the United States, Canada and Puerto Rico primarily under the trade names of

Regis Salons, MasterCuts, SmartStyle, Supercuts and Cost Cutters. Our international salon operations include 404 salons located in Europe,

primarily in the United Kingdom. Hair Club for Men and Women includes 95 North American locations, including 33 franchise locations.

During fiscal year 2010, we had approximately 56,000 corporate employees worldwide.

Our growth strategy consists of two primary, but flexible, components. Through a combination of organic and acquisition growth, we seek

to achieve our long-term objective of six to ten percent annual revenue growth. We anticipate that going forward, the mix of organic and

acquisition growth will be roughly equal. However, depending on several factors, including the ability of our salon development program to

keep pace with the availability of real estate for new construction, hair restoration lead generation, the availability of attractive acquisition

candidates and same-store sales trends, this mix will vary from year to year. Due to the current economic conditions we have recently reduced

the pace of our new salon development and salon acquisitions. We expect to continue with our historical trend of building and/or acquiring 700

to 1,000 salons each year once the economy normalizes.

Maintaining financial flexibility is a key element in continuing our successful growth. With strong operating cash flow and balance sheet,

we are confident that we will be able to financially support our long-term growth objectives.

Salon Business

The strength of our salon business is in the fundamental similarity and broad appeal of our salon concepts that allow flexibility and

multiple salon concept placements in shopping centers and neighborhoods. Each concept generally targets the middle market customer,

however, each attracts a different demographic. We believe there are growth opportunities in all of our salon concepts. When commercial

opportunities arise, we anticipate testing and developing new salon concepts to complement our existing concepts.

We execute our salon growth strategy by focusing on real estate. Our salon real estate strategy is to add new units in convenient locations

with good visibility and customer traffic, as well as appropriate trade demographics. Our various salon and product concepts operate in a wide

range of retailing environments, including regional shopping malls, strip centers and Wal-

Mart Supercenters. We believe that the availability of

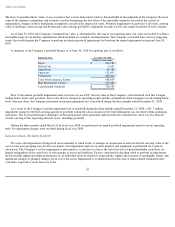

real estate will augment our ability to achieve the aforementioned long-term growth objectives. In fiscal year 2011, our outlook for constructed

salons will be 160 units. Capital expenditures and acquisitions are expected to be approximately $95.0 and $25.0 million in fiscal year 2011,

respectively.

Organic salon revenue growth is achieved through the combination of new salon construction and salon same-store sales increases. Once

the economy normalizes, we expect we will continue with our historical trend of building several hundred company-owned salons. We

anticipate our franchisees will open approximately 70 to 100 salons in fiscal year 2011. Older, unprofitable salons will be closed or relocated.

Our long-term outlook for our salon business is for annual consolidated low single digit same-store sales increases. Based on current fashion

and economic cycles (i.e., longer hairstyles and lengthening of customer visitation patterns), we project our annual fiscal year 2011

consolidated same-store sales to be in the range of negative 1.0 percent to positive 2.0 percent.

Historically, our salon acquisitions have varied in size from as small as one salon to over one thousand salons. The median acquisition size

is approximately ten salons. From fiscal year 1994 to fiscal year 2010, we acquired 8,023 salons, net of franchise buybacks. Once the economy

normalizes, we anticipate adding several hundred company-owned salons each year from acquisitions. Some of these acquisitions may include

buying salons from our franchisees.

32