Supercuts 2010 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2010 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221

|

|

PROVALLIANCE SAS

CONSOLIDATED FINANCIAL STATEMETS

DECEMBER 31, 2009 AND 2008

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(INFORMATION AS OF DECEMBER 31, 2009 AND FOR THE YEAR THEN ENDED NOT

COVERED BY AUDITORS' REPORT INCLUDED HEREIN)

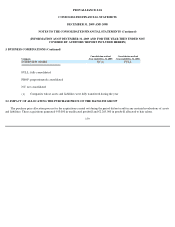

1.2 FINANCIAL RISK MANAGEMENT (Continued)

1.2.1.1 Trade and other receivables

The Group does not have any significant credit risk exposure on trade receivables as hairdressing services are paid for by customers on a

cash basis and defaults by franchisees are rare.

Other receivables mainly correspond to prepaid and recoverable payroll and other taxes.

1.2.1.2 Investments

The Group restricts its exposure to this type of credit risk by only using short-term liquid investments.

1.2.1.3 Guarantees

The Group only grants financial guarantees to wholly-owned subsidiaries.

1.2.1.4 Bank counterparties

The Group only enters into financial undertakings with major financial institutions.

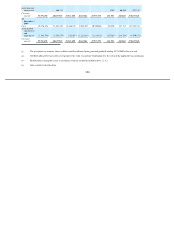

1.2.2 Liquidity risk

Liquidity risk corresponds to the risk that the Group will experience difficulties in honoring its debts when they fall due. The Group

manages liquidity risk by ensuring that, to the extent possible, it will always have sufficient liquidity to settle its liabilities when they fall due,

either in normal conditions or in difficult circumstances, without incurring unacceptable losses or damaging the Group's image.

The Group draws up earnings and cash flow forecasts for each hair salon it owns, which helps it to manage its cash flow needs and

optimize its cash return on investments.

The Group generally ensures that it has sufficient demand deposits to cover its expected operating expenses for each coming month,

including the amounts required to service its debt. However, these funds do not factor in the potential impact of extreme circumstances that

cannot be reasonably anticipated.

The Group has entered into bank covenants with several financial institutions for the purpose of setting up external financing. The

applicable ratios under these covenants—which vary depending on the type of acquisition involved—are as follows:

• Consolidated net debt/consolidated equity < 1 and Consolidated net debt/consolidated cash flow < 4

• Consolidated net debt/consolidated equity < 0.75 and Consolidated net debt/consolidated EBITDA < 3.5

• Consolidated net debt/equity < 0.75 and Consolidated net debt/consolidated cash flow < 3.5

171