Supercuts 2010 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2010 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

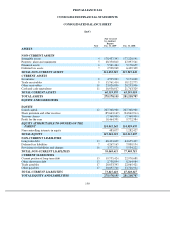

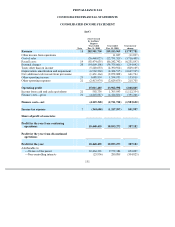

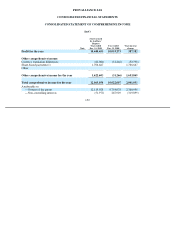

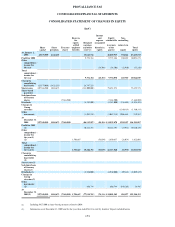

PROVALLIANCE SAS

CONSOLIDATED FINANCIAL STATEMETS

DECEMBER 31, 2009 AND 2008

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(INFORMATION AS OF DECEMBER 31, 2009 AND FOR THE YEAR THEN ENDED NOT

COVERED BY AUDITORS' REPORT INCLUDED HEREIN)

1.1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Associates

Associates are all entities over which the Group has significant influence. Significant influence is the power to participate in the financial

and operating policy decisions of the investee but is not control over those policies. The results of associates are incorporated in these

consolidated financial statements using the equity method of accounting as from the date that the Group begins to exercise significant influence

until the date that such significant influence ceases. If the Group's share of losses of an associate exceeds its interest in the associate, the

interest is written down to zero and the Group discontinues recognizing its share of further losses unless it has incurred legal or constructive

obligations to participate in the losses or to make payments on behalf of the associate.

Interests in joint ventures

A joint venture is a contractual arrangement whereby the Group and other parties undertake an economic activity that is subject to joint

control. The consolidated financial statements include the Group's share of each of the assets, liabilities, income and expenses of a jointly

controlled entity, combined line by line with similar items in the Group's financial statements using the proportionate consolidation method.

This accounting method is applied as from the date when joint control is obtained until the date that such control ceases.

Eliminations on consolidation

Inter-company transactions, balances and unrealized gains and losses on transactions between Group companies are eliminated in the

consolidated financial statements. Unrealized gains on transactions with associates and jointly-

controlled entities are eliminated to the extent of

the Group's interest in the entity concerned. Unrealized losses are also eliminated unless the transaction provides evidence of an impairment of

the asset transferred.

At December 31, 2009 all of the companies included in the scope of consolidation were subsidiaries except for one special purpose entity,

A.F.A.P (Association de Formation Artistique Professionnelle). Prior to consolidation the financial statements of subsidiaries are restated to

comply with Group accounting policies.

A list of consolidated companies is provided in Note 2.

1.1.4 Intangible assets

1.1.4.1 Business combinations—Goodwill

The Group has elected not to apply IFRS 3 retrospectively to business combinations that occurred prior to January 1, 2004. Goodwill

arising prior to that date has continued to be recorded at deemed cost which represents their previous GAAP carrying amount.

159