Supercuts 2010 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2010 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

15. SHAREHOLDERS' EQUITY (Continued)

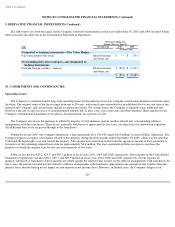

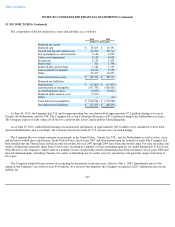

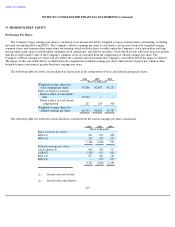

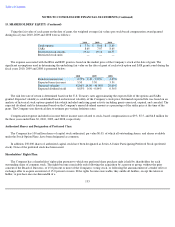

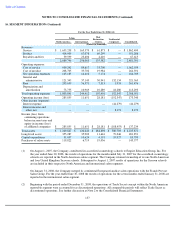

The following table sets forth a reconciliation of the net income from continuing operations available to common shareholders and the net

income from continuing operations for diluted earnings per share under the if-converted method:

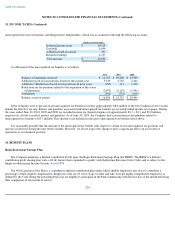

Stock-based Compensation Award Plans:

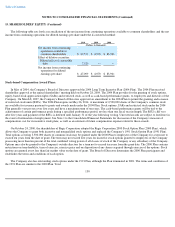

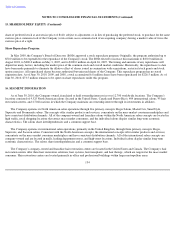

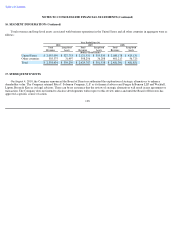

In May of 2004, the Company's Board of Directors approved the 2004 Long Term Incentive Plan (2004 Plan). The 2004 Plan received

shareholder approval at the annual shareholders' meeting held on October 28, 2004. The 2004 Plan provides for the granting of stock options,

equity-based stock appreciation rights (SARs) and restricted stock, as well as cash-based performance grants, to employees and directors of the

Company. On March 8, 2007, the Company's Board of Directors approved an amendment to the 2004 Plan to permit the granting and issuance

of restricted stock units (RSUs). The 2004 Plan expires on May 26, 2014. A maximum of 2,500,000 shares of the Company's common stock

are available for issuance pursuant to grants and awards made under the 2004 Plan. Stock options, SARs and restricted stock under the 2004

Plan generally vest pro rata over five years and have a maximum term of ten years. The cash-based performance grants will be tied to the

achievement of certain performance goals during a specified performance period, not less than one fiscal year in length. The RSUs cliff vest

after five years and payment of the RSUs is deferred until January 31 of the year following vesting. Unvested awards are subject to forfeiture in

the event of termination of employment. See Note 1 to the Consolidated Financial Statements for discussion of the Company's measure of

compensation cost for its incentive stock plans, as well as an estimate of future compensation expense related to these awards.

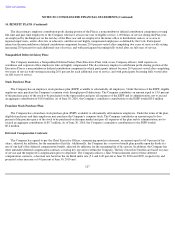

On October 24, 2000, the shareholders of Regis Corporation adopted the Regis Corporation 2000 Stock Option Plan (2000 Plan), which

allows the Company to grant both incentive and nonqualified stock options and replaced the Company's 1991 Stock Option Plan (1991 Plan).

Total options covering 3,500,000 shares of common stock may be granted under the 2000 Plan to employees of the Company for a term not to

exceed ten years from the date of grant. The term may not exceed five years for incentive stock options granted to employees of the Company

possessing more than ten percent of the total combined voting power of all classes of stock of the Company or any subsidiary of the Company.

Options may also be granted to the Company's outside directors for a term not to exceed ten years from the grant date. The 2000 Plan contains

restrictions on transferability, time of exercise, exercise price and on disposition of any shares acquired through exercise of the options. Stock

options are granted at not less than fair market value on the date of grant. The Board of Directors determines the 2000 Plan participants and

establishes the terms and conditions of each option.

The Company also has outstanding stock options under the 1991 Plan, although the Plan terminated in 2001. The terms and conditions of

the 1991 Plan are similar to the 2000 Plan. Total

130

2010 2009 2008

(Dollars in thousands)

Net income from continuing

operations available to

common shareholders

$

39,579

$

6,970

$

83,901

Effect of dilutive securities:

Diluted effect of convertible

debt

7,520

—

—

Net income from continuing

operations for diluted

earnings per share

$

47,099

$

6,970

$

83,901