Supercuts 2010 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2010 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

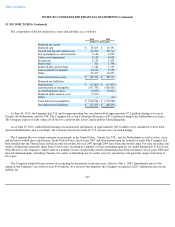

13. INCOME TAXES (Continued)

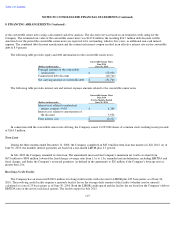

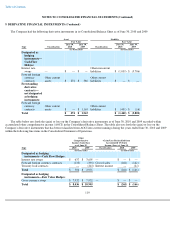

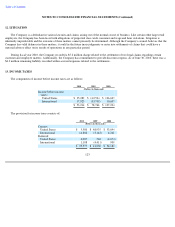

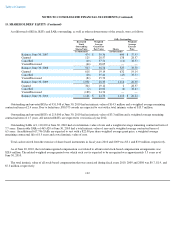

The components of the net deferred tax assets and liabilities are as follows:

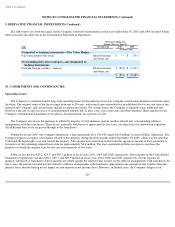

At June 30, 2010, the Company had U.S. and foreign operating loss carryforwards of approximately $7.2 million relating to losses in

Canada, the Netherlands, and the U.K. The Company has set up a valuation allowance of $1.0 million relating to the Netherlands tax losses.

The Company expects to fully utilize all of the loss carryforwards from Canada and the United Kingdom.

As of June 30, 2010, undistributed earnings of international subsidiaries of approximately $23.8 million were considered to have been

reinvested indefinitely and, accordingly, the Company has not provided for U.S. income taxes on such earnings.

The Company files tax returns and pays tax primarily in the United States, Canada, the U.K., and the Netherlands as well as states, cities,

and provinces within these jurisdictions. In the United States, fiscal years 2007 and after remain open for federal tax audit. The Company has

been notified that the United States federal income tax returns for year 2007 through 2009 have been selected for audit. For state tax audits, the

statute of limitations generally spans three to four years, resulting in a number of states remaining open for tax audits dating back to fiscal year

2006. However, the company is under audit in a number of states in which the statute of limitations has been extended to fiscal years 2000 and

forward. Internationally (including Canada), the statute of limitations for tax audits varies by jurisdiction, but generally ranges from three to

five years.

The Company adopted the provisions of accounting for uncertainty in income taxes, effective July 1, 2007. Immediately prior to the

adoption, the Company's tax reserves were $9.0 million. As a result of the adoption, the Company recognized a $20.7 million increase in the

liability for

125

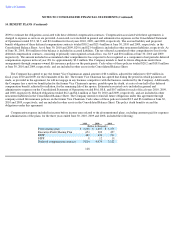

2010 2009

(Dollars in thousands)

Deferred tax assets:

Deferred rent

$

15,677

$

15,591

Payroll and payroll related costs

34,294

32,712

Net operating loss carryforwards

2,106

2,078

Salon asset impairment

4,154

6,953

Inventories

3,136

4,478

Derivatives

311

1,798

Deferred gift card revenue

1.581

1,703

Unrecognized tax benefits

10,178

7,553

Other

12,357

10,851

Total deferred tax assets

$

83,794

$

83,717

Deferred tax liabilities:

Depreciation

$

(17,603

)

$

(17,454

)

Amortization of intangibles

(107,392

)

(100,502

)

Accrued property taxes

(2,029

)

(2,001

)

Deferred debt issuance costs

(7,937

)

Other

—

(

11

)

Total deferred tax liabilities

$

(134,961

)

$

(119,968

)

Net deferred tax liabilities

$

(51,167

)

$

(36,251

)