Supercuts 2010 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2010 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221

|

|

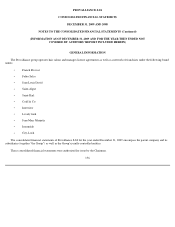

PROVALLIANCE SAS

CONSOLIDATED FINANCIAL STATEMETS

DECEMBER 31, 2009 AND 2008

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(INFORMATION AS OF DECEMBER 31, 2009 AND FOR THE YEAR THEN ENDED NOT

COVERED BY AUDITORS' REPORT INCLUDED HEREIN)

1.1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

These trademarks were recognized at fair value based on the expected profit to be generated through their related licenses and franchise

network.

Trademarks are amortized over the following periods:

• Jean-Louis David and Saint-Algue: 25 years

• Coiff & Co, Intermède and City-Look: 20 years

In addition, where there is an indication that the value of a trademark may be impaired it is tested for impairment in accordance with the

principles described in Note 1.1.6 "Impairment of non-current assets".

As trademarks correspond to identifiable assets, they give rise to a deferred tax liability.

1.1.4.4 Franchise networks

Franchise agreements acquired as part of a business combination are measured based on the expected future cash flows to be generated by

the franchise network, less the value of the brand and taking into account the probability of renewal of agreements reaching maturity.

Franchise networks are amortized over 15 years.

As franchise networks correspond to identifiable assets they give rise to a deferred tax liability.

1.1.4.5 Other intangible assets

The Group has not capitalized any development costs.

Other intangible assets—notably software acquired for internal use—are amortized over their estimated useful lives, which generally

correspond to three years. In the income statement, amortization expense is recorded as an operating expense under the line "Depreciation,

amortization and impairment".

Other intangible assets are carried at cost less accumulated amortization and any accumulated impairment losses.

1.1.5 Property, plant and equipment

The Group has opted to apply the cost model rather than the revaluation model for measuring property, plant and equipment.

Consequently, property, plant and equipment are stated at cost less accumulated depreciation and any accumulated impairment losses. In

accordance with IAS 23, borrowing costs are not included in the cost of property, plant and equipment.

161