Supercuts 2010 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2010 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

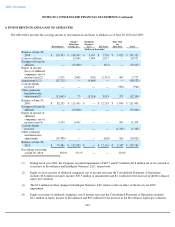

6. INVESTMENTS IN AND LOANS TO AFFILIATES (Continued)

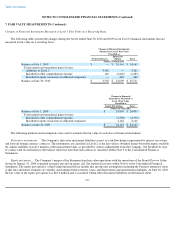

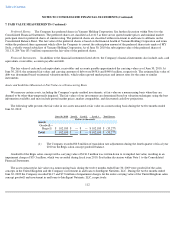

ownership interest in Provalliance between specific dates in 2018 to 2020 at an acquisition price determined consistent with the Equity Put.

The Company utilized the consolidation of variable interest entities guidance to determine whether or not its investment in Provalliance

was a VIE, and if so, whether the Company was the primary beneficiary of the VIE. The Company concluded that Provalliance is a VIE based

on the fact that the holders of the equity investment at risk, as a group, lack the obligation to absorb the expected losses of the entity. The

Equity Put is based on a formula that may or may not be at market when exercised, therefore, it could provide the Company with the

characteristic of a controlling financial interest or could prevent the Franck Provost Salon Group from absorbing its share of expected losses by

transferring such obligation to the Company. Under certain circumstances, including a decline in the fair value of Provalliance, the Equity Put

could be exercised and the Franck Provost Group could be protected from absorbing the downside of the equity interest. As the Equity Put

absorbs a large amount of variability this characteristic results in Provalliance being a VIE.

Regis determined that the relationship and the significance of the activities of Provalliance is more closely associated with the Franck

Provost Group. Furthermore, the Company determined, based on a quantitative analysis that the Franck Provost Group has greater exposure to

the expected losses of Provalliance. The variability that the Company could be required to absorb via its equity interest in Provalliance and its

expanded interest via exercise of the Equity Put was determined to be well less than 50.0 percent. The Company concluded based on the

considerations above that the primary beneficiary of Provalliance is the Franck Provost Group. The Company has accounted for its interest in

Provalliance as an equity method investment.

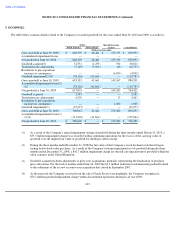

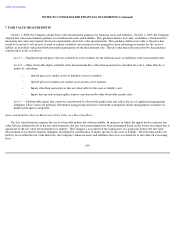

During fiscal years 2010 and 2009, the Company recorded $4.1 and $2.0 million, respectively, of equity in income related to its

investment in Provalliance. Due to increased debt and reduced earnings expectations, the Company could no longer justify the carrying amount

of its investment in Provalliance and recorded a $25.7 million "other-than-temporary" impairment charge in its fourth quarter ended June 30,

2009. The exposure to loss related to the Company's involvement with Provalliance is the carrying value of the investment and future changes

in fair value of the Equity Put.

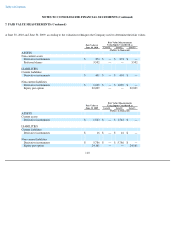

Investment in Empire Education Group, Inc.

On August 1, 2007, the Company contributed its 51 wholly-owned accredited cosmetology schools to Empire Education Group, Inc.

(EEG) in exchange for a 49.0 percent equity interest in EEG. In January 2008, the Company's effective ownership interest increased to

55.1 percent related to the buyout of EEG's minority interest shareholder. EEG operates 96 accredited cosmetology schools.

At June 30, 2010 and 2009, the Company had a $21.4 million outstanding loan receivable with EEG. The Company has also provided

EEG with a $15.0 million revolving credit facility, against which there was no outstanding borrowings as of June 30, 2010 and $15.0 million

outstanding as of June 30, 2009. During fiscal year 2010 and 2009, the Company recorded $0.7 and $0.9 million, respectively, of interest

income related to the loan and revolving credit facility. The Company has also guaranteed a credit facility of EEG. The exposure to loss related

to the Company's involvement with EEG is the carrying value of the investment, the outstanding loan and the guarantee of the credit facility.

The Company utilized consolidation of variable interest entities guidance to determine whether or not its investment in EEG was a

variable interest entity (VIE), and if so, whether the Company was the primary beneficiary of the VIE. The Company concluded that EEG was

not a VIE based on the fact that EEG had sufficient equity at risk. As the substantive voting control relates to the voting rights of

106