Supercuts 2010 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2010 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221

|

|

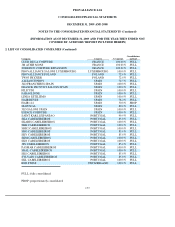

PROVALLIANCE SAS

CONSOLIDATED FINANCIAL STATEMETS

DECEMBER 31, 2009 AND 2008

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(INFORMATION AS OF DECEMBER 31, 2009 AND FOR THE YEAR THEN ENDED NOT

COVERED BY AUDITORS' REPORT INCLUDED HEREIN)

1.1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

1.1.17 Share grants

In 2008, Provalliance set up a share grant plan for which an expense was recorded under payroll costs, in accordance with IFRS 2. The

expense corresponding to the shares to be granted free of consideration is being recognized over the term of the plan, based on the probability

that the underlying targets will be achieved.

The main features of the plan are as follows:

• Maximum number of shares that may be granted: 10,527,000

• Value of shares used for calculation: €0.70 per share

• Vesting conditions:

• Eight tranches, all with conditions based on the grantees still forming part of the Group and achieving consolidated

EBITDA targets during the vesting period

• Vesting period: minimum of two years and maximum of 15 years depending on the different tranches

• Number of shares granted during the year: 0

• Number of shares forfeited during the year: 0

An expense of €880,000 was recorded in relation to this plan in 2009, with a corresponding adjustment to equity.

1.1.18 Equity warrants

Provalliance set up an equity warrant plan during 2008 under which it issued 17,750,000 warrants in two tranches. The first tranche

comprised 9,341,826 warrants with a per-warrant purchase price of €0.08 (based on fair value) and an exercise price of €1.02, and the second

tranche represented 8,408,174 warrants with a per-warrant purchase price of €0.04 (based on fair value) and an exercise price of €1.27.

The warrants issued under both of the tranches have an exercise period running from July 30, 2010 to December 31, 2018 and are subject

to performance conditions based on consolidated EBITDA targets.

At December 31, 2009 a total of 17,750,000 warrants were outstanding. No warrants were exercised or forfeited during the year.

The main data used to calculate the fair value of these warrants were as follows:

• Valuation model: Black and Scholes.

167