Supercuts 2003 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2003 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

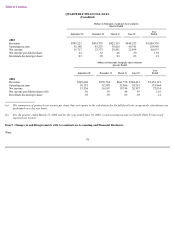

Table of Contents

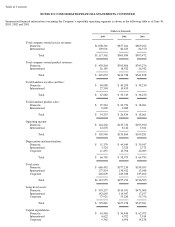

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

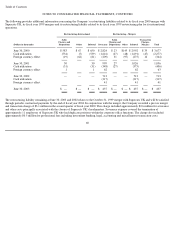

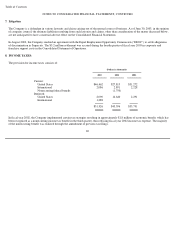

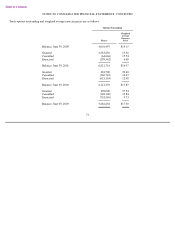

The components of the net deferred tax asset (liability) are as follows:

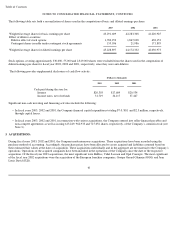

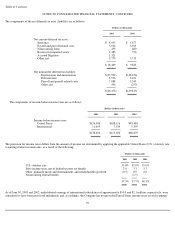

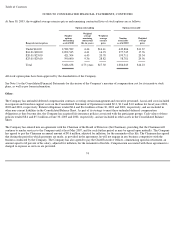

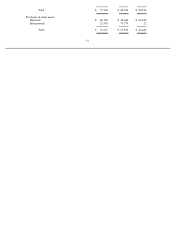

The components of income before income taxes are as follows:

The provision for income taxes differs from the amount of income tax determined by applying the applicable United States (U.S.) statutory rate

to earnings before income taxes, as a result of the following:

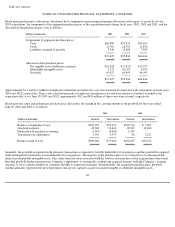

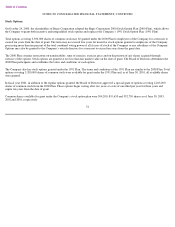

As of June 30, 2003 and 2002, undistributed earnings of international subsidiaries of approximately $10.0 and $2.1 million, respectively, were

considered to have been reinvested indefinitely and, accordingly, the Company has not provided United States income taxes on such earnings.

70

(Dollars in thousands)

2003

2002

Net current deferred tax asset:

Insurance

$

8,415

$

1,677

Payroll and payroll related costs

3,014

3,015

Nonrecurring items

455

680

Reserve for impaired assets

1,485

756

Accrued litigation

1,321

Other, net

3,779

3,715

$

18,469

$

9,843

Net noncurrent deferred tax liability:

Depreciation and amortization

$

(37,592

)

$

(38,126

)

Deferred rent

3,576

3,221

Payroll and payroll related costs

7,088

5,345

Other, net

456

(253

)

$

(26,472

)

$

(29,813

)

(Dollars in thousands)

2003 2002 2001

Income before income taxes:

United States

$

126,906

$

108,116

$

83,484

International

11,695

7,534

5,395

$

138,601

$

115,650

$

88,879

(Dollars in thousands)

2003

2002

2001

U.S. statutory rate

35.0

%

35.0

%

35.0

%

State income taxes, net of federal income tax benefit

3.0

3.3

3.3

Other, primarily meals and entertainment, and nondeductible goodwill

(0.5

)

0.9

2.0

Nonrecurring federal benefit

(1.5

)

37.5

%

37.7

%

40.3

%