Supercuts 2003 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2003 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

69

7.

Litigation

The Company is a defendant in various lawsuits and claims arising out of the normal course of business. As of June 30, 2003, in the opinion

of company counsel, the ultimate liabilities resulting from such lawsuits and claims, other than consideration of the matter discussed below,

are not anticipated to have a material adverse effect on the Consolidated Financial Statements.

In August 2003, the Company reached an agreement with the Equal Employment Opportunity Commission (“EEOC”) to settle allegations

of discrimination in Supercuts. The $3.2 million settlement was accrued during the fourth quarter of fiscal year 2003 in corporate and

franchise support costs in the Consolidated Statement of Operations.

8.

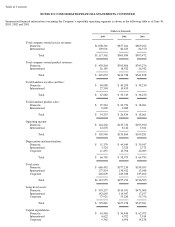

INCOME TAXES:

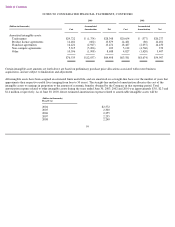

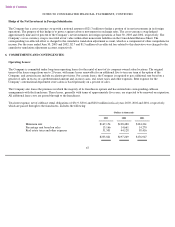

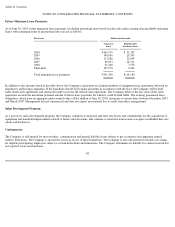

The provision for income taxes consists of:

(Dollars in thousands)

2003 2002 2001

Current:

United States

$

46,462

$

27,815

$

31,272

International

2,086

2,891

2,228

Nonrecurring federal benefit

(1,750

)

Deferred:

United States

2,090

14,640

2,291

International

1,288

$

51,926

$

43,596

$

35,791

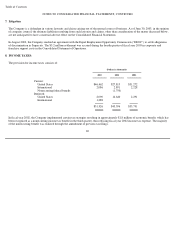

In fiscal year 2002, the Company implemented certain tax strategies resulting in approximately $1.8 million of economic benefit, which has

been recognized as a nonrecurring income tax benefit in the third quarter, thus reducing fiscal year 2002 income tax expense. The majority

of the nonrecurring benefit was realized through the amendment of previous tax filings.