Supercuts 2003 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2003 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

53

Advertising:

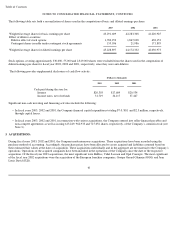

Advertising costs are expensed as incurred. Advertising costs expensed were $41.3, $31.3 and $29.5 million in fiscal years 2003, 2002

and 2001, respectively.

Advertising Funds:

Franchisees and certain company-owned salons are required to contribute a percentage of sales to various advertising funds. The

Company administers the advertising funds at the directive of or subject to input from the franchise community. Accordingly, amounts

collected and spent by the advertising funds are not reflected as revenues and expenditures of the Company. Assets of the advertising

funds administered by the Company, along with an offsetting obligation to spend such assets, are recorded in the Consolidated Balance

Sheet.

Income Taxes:

Deferred income tax assets and liabilities are recognized for the expected future tax consequences of events that have been included in the

Consolidated Financial Statements or income tax returns. Deferred income tax assets and liabilities are determined based on the

differences between the financial statement and tax basis of assets and liabilities using currently enacted tax rates in effect for the years in

which the differences are expected to reverse. Realization of deferred tax assets is ultimately dependent upon future taxable income.

Inherent in the measurement of deferred balances are certain judgments and interpretations of tax laws and published guidance with

respect to the Company’s operations. No valuation allowance has been provided for deferred tax assets because management believes the

full amount of the net deferred tax assets will be realized. Income tax expense is the current tax payable for the period and the change

during the period in certain deferred tax assets and liabilities.

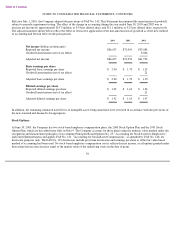

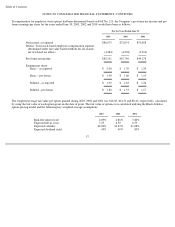

Net Income Per Share:

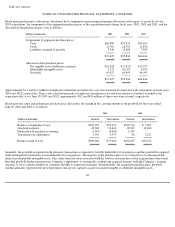

Basic earnings per share (EPS) is calculated as net income divided by weighted average common shares outstanding. The Company’s

dilutive securities include shares issuable under the Company’s stock option plan and shares issuable under contingent stock agreements.

Diluted EPS is calculated as net income divided by weighted average common shares outstanding, increased to include assumed exercise

of dilutive securities. Stock options with exercise prices greater than the average market value of the Company’s common stock are

excluded from the computation of diluted EPS.

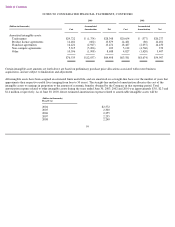

Comprehensive Income:

Components of comprehensive income for the Company include net income, the transition adjustment for the adoption of FAS No. 133,

“Accounting for Derivative Instruments and Hedging Activities,” as amended and interpreted, changes in fair market value of financial

instruments designated as hedges of interest rate exposure and foreign currency translation charged or credited to the cumulative

translation account within shareholders’ equity. These amounts are presented in the Consolidated Statements of Changes in Shareholders’

Equity and Comprehensive Income.