Supercuts 2003 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2003 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

52

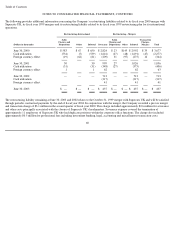

Goodwill is tested for impairment annually or at the time of a triggering event in accordance with the provisions of Statement of Financial

Accounting Standards (FAS) No. 142, “Goodwill and Other Intangible Assets.” Fair values are estimated based on the Company’s best

estimate of the expected present value of future cash flows and compared with the corresponding carrying value of the reporting unit,

including goodwill. The Company generally considers its various concepts to be reporting units when it tests for goodwill impairment

because that is where the Company believes goodwill naturally resides. During the third quarter of fiscal year 2003, goodwill was tested

for impairment in this manner. The net book value of the recently purchased European franchise operations approximated its fair value

and the estimated fair value of the remaining reporting units exceeded their carrying amounts, indicating no impairment of goodwill.

Asset Impairment Assessments:

The Company reviews long-lived assets for impairment at the salon level annually or if events or circumstances indicate that the carrying

value of such assets may not be fully recoverable. Impairment is evaluated based on the sum of undiscounted estimated future cash flows

expected to result from use of the assets compared to its carrying value. If an impairment is recognized, the carrying value of the impaired

asset is reduced to its fair value, based on discounted estimated future cash flows.

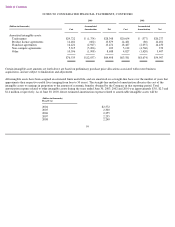

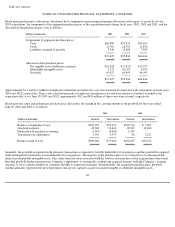

During the fourth quarter of fiscal years 2003, 2002 and 2001, the Company tested its long-lived assets for impairment as discussed

above and recognized impairment charges related to the carrying value of certain salons’ property and equipment of $3.1, $1.3 and

$1.1 million, respectively. During fiscal year 2002, approximately $0.3 million of the impairment charges were related to the international

operations. There were no impairment charges related to the international operations during fiscal years 2003 and 2001. Impairment

charges are included in depreciation related to company

-

owned salons in the Consolidated Statement of Operations.

Deferred Rent:

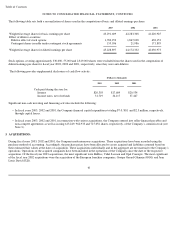

The Company’s operating lease agreements include certain escalation provisions. Accounting principles generally accepted in the United

States of America require rent expense to be recognized on a straight-line basis over the lease term. The difference between the rent due

under the stated terms of the lease compared to that of the straight-

line basis is recorded as deferred rent within other noncurrent liabilities

in the Consolidated Balance Sheet.

Franchise Revenues and Expenses:

Franchise revenues include royalties, initial franchise fees from franchisees and sales of product to franchisees. Royalties are recognized

as revenue in the month in which franchisee services are rendered or products are sold by franchisees. The Company recognizes revenue

from initial franchise fees at the time franchisee salons are opened. Product sales by the Company to franchisees are recorded at the time

product is shipped to franchise locations. Franchise expenses included in franchise direct costs in the Consolidated Statement of

Operations include all direct expenses, such as the cost of product sold to franchisees. All other indirect expenses associated with

franchise operations are included in corporate and franchise support costs in the Consolidated Statement of Operations.