Supercuts 2003 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2003 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

66

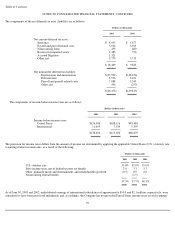

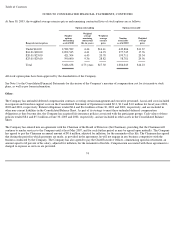

On June 20, 2003, the Company exercised its right to purchase a leased warehouse under a variable rate operating lease. As a result, in fiscal

year 2003, a tax

-effected loss of approximately $0.5 million was transferred out of other comprehensive income into net income because it

was no longer probable that the forecasted variable lease payments would occur.

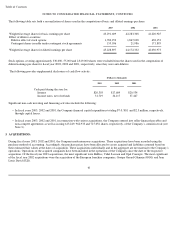

(Pay variable rates, receive fixed rates)

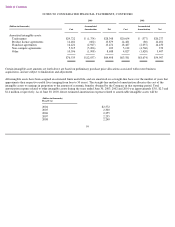

The Company has interest rate swap contracts to pay variable rates of interest based on the three-month and six-month LIBOR rates plus a

credit spread (ranging from 2.2 to 6.3 percent during fiscal year 2003 and 2.8 to 6.5 percent during fiscal year 2002) and receive fixed rates

of interest (ranging from 6.7 to 8.2 percent) on an aggregate $88.5 million notional amount at June 30, 2003 and $111.0 million notional

amount at June 30, 2002, with maturation dates between July 2003 and March 2009. These swaps were designated as hedges of a portion of

the Company

’

s senior term notes and are being accounted for as fair value swaps.

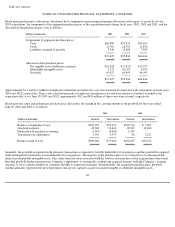

During the second quarter of fiscal year 2003, the Company terminated a portion of its $40 million interest rate swap contract, thereby

lowering the aggregate notional amount by $20.0 million. The termination resulted in the Company realizing a gain of $1.5 million, which is

deferred in long-term debt in the Consolidated Balance Sheet and will be amortized against interest expense over the remaining life of the

underlying debt, which will mature in March 2009. During fiscal year 2003, approximately $0.1 million of the deferred gain was amortized

against interest expense, resulting in a deferred gain of $1.4 million in long

-

term debt at June 30, 2003.

The Company’s fair value swaps are recorded at fair value within other assets in the Consolidated Balance Sheet, with a corresponding

adjustment to the underlying senior term note within long-term debt of $7.1 and $2.3 million at June 30, 2003 and 2002, respectively. No

hedge ineffectiveness occurred during fiscal year 2003. As a result, the fair value swaps did not have a net impact on earnings.

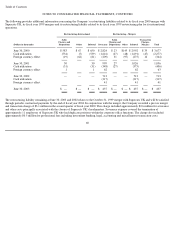

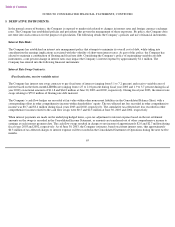

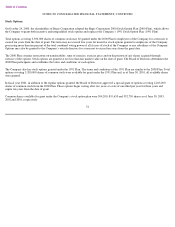

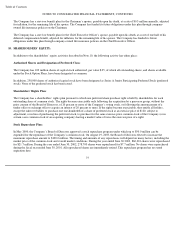

Foreign Currency Exchange Risk:

The majority of the Company’s revenue, expense and capital purchasing activities are transacted in United States dollars. However, because

a portion of the Company’s operations consists of activities outside of the United States, the Company has transactions in other currencies,

primarily the Canadian dollar, British pound and Euro. In preparing the Consolidated Financial Statements, the Company is required to

translate the financial statements of its foreign subsidiaries from the currency in which they keep their accounting records, generally the

local currency, into United States dollars. Different exchange rates from period to period impact the amounts of reported income and the

amount of foreign currency translation recorded in accumulated other comprehensive income. As part of its risk management strategy, the

Company frequently evaluates its foreign currency exchange risk by monitoring market data and external factors that may influence

exchange rate fluctuations. As a result, Regis may engage in transactions involving various derivative instruments to hedge assets, liabilities

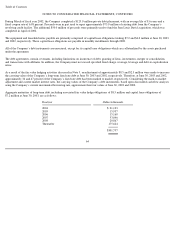

and purchases denominated in foreign currencies. As of June 30, 2003, the Company has entered into the following financial instrument: