Supercuts 2003 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2003 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

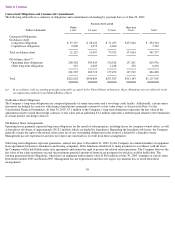

In certain franchise area development agreements, a buyback program is included allowing the franchisee to require the Company to purchase

all of their salon assets within a specified market for 90 percent of their original cost within two years from the date of the franchisee opening

their first salon. As of June 30, 2003, 22 existing franchised salons were covered by such agreements and the related maximum potential

amount of undiscounted future payments was estimated to be approximately $1.5 million. This potential obligation is not included in the table

above as the opportunity or the timing of the potential expenditures cannot be reasonably estimated. The Company has not and does not expect

to incur material expenditures under the buyback program as most franchisees choose to continue operating the salons themselves. Further, in

the case of a franchisee initiating the buyback program, the Company anticipates finding another franchisee to purchase the salons directly

rather than purchasing them itself.

The Company entered into a five-year operating lease agreement in June 2000 relating to its Salt Lake distribution center. Based on the

Company’s analysis of Interpretation No. 46, “Consolidation of Variable Interest Entities,” the operating lease structure was with a variable

interest entity and would have required the Company to consolidate the leased asset and the related debt in its Consolidated Financial

Statements effective July 1, 2003, if no modifications were made to the lease structure. The Company exercised its option to buy the

distribution center for $11.8 million and discontinued the lease agreement during June 2003. Therefore, the related asset and debt are included

in the Consolidated Financial Statements at June 30, 2003.

The Company has interest rate swap contracts, as well as a cross-currency swap to hedge a portion of its net investments in foreign operations.

See Note 5 to the Consolidated Financial Statements for a detailed discussion of the Company’s derivative instruments.

The Company does not have other unconditional purchase obligations, or significant other commercial commitments such as commitments

under lines of credit, standby letters of credit and standby repurchase obligations or other commercial commitments.

The Company is in compliance with all covenants and other requirements of its credit agreements and senior notes. Additionally, the credit

agreements do not include rating triggers or subjective clauses that would accelerate maturity dates.

As a part of its salon development program, the Company continues to negotiate and enter into leases and commitments for the acquisition of

equipment and leasehold improvements related to future salon locations, and continue to enter into transactions to acquire established hair care

salons and businesses.

The Company does not have any relationships with unconsolidated entities or financial partnerships, such as entities often referred to as

structured finance or special purpose entities (SPEs), which would have been established for the purpose of facilitating off-balance sheet

financial arrangements or other contractually narrow or limited purposes at June 30, 2003. As such, the Company is not materially exposed to

any financing, liquidity, market or credit risk that could arise if the Company had engaged in such relationships.

Financing

Financing activities are discussed on page 35 and in Note 4 to the Consolidated Financial Statements, and derivative activities are discussed in

Item 7A. Quantitative and Qualitative Disclosures about Market Risk and in Note 5 to the Consolidated Financial Statements.

37