Supercuts 2003 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2003 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

56

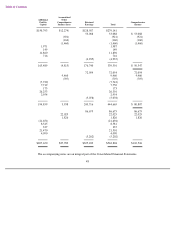

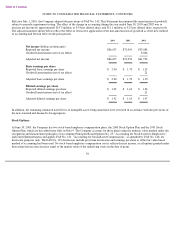

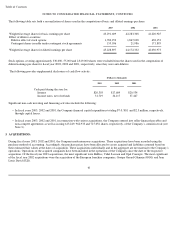

Effective July 1, 2001, the Company adopted the provisions of FAS No. 142. This Statement discontinued the amortization of goodwill,

subject to periodic impairment testing. The effect of the change in accounting during the year ended June 30, 2003 and 2002 was to

increase net income by approximately $15.3 million, or $.34 per diluted share, and $11.1 million, or $.25 per diluted share, respectively.

The adjusted amounts shown below reflect the effect of retroactive application of the non-amortization of goodwill as if the new method

of accounting had been in effect in the prior periods.

2003 2002 2001

Net income

(Dollars in thousands)

Reported net income

$

86,675

$

72,054

$

53,088

Goodwill amortization (net of tax effect)

8,866

Adjusted net income

$

86,675

$

72,054

$

61,954

Basic earnings per share

Reported basic earnings per share

$

2.00

$

1.70

$

1.29

Goodwill amortization (net of tax effect)

.21

Adjusted basic earnings per share

$

2.00

$

1.70

$

1.50

Diluted earnings per share

Reported diluted earnings per share

$

1.92

$

1.63

$

1.26

Goodwill amortization (net of tax effect)

.21

Adjusted diluted earnings per share

$

1.92

$

1.63

$

1.47

In addition, the remaining estimated useful lives of intangible assets being amortized were reviewed in accordance with the provisions of

the new standard and deemed to be appropriate.

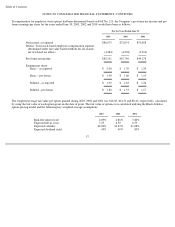

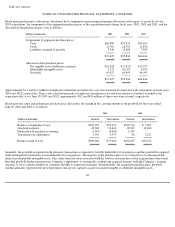

Stock Options:

At June 30, 2003, the Company has two stock-based employee compensation plans, the 2000 Stock Option Plan and the 1991 Stock

Option Plan, which are described more fully in Note 9. The Company accounts for those plans using the intrinsic value method under the

recognition and measurement principles of Accounting Principles Board Opinion No. 25, “Accounting for Stock Issued to Employees,”

and related Interpretations and applies FAS No. 123, “Accounting for Stock-Based Compensation,” as amended by FAS No. 148, for

disclosure purposes only. The FAS No. 123 disclosures include pro forma net income and earnings per share as if the fair value-based

method of accounting had been used. No stock-based employee compensation cost is reflected in net income, as all options granted under

those plans had an exercise price equal to the market value of the underlying stock on the date of grant.