Supercuts 2003 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2003 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

During March of fiscal year 2002, the Company completed a $125.0 million private debt placement, with an average life of 8.6 years and a

fixed coupon rate of 6.98 percent. Proceeds were in part used to repay approximately $75.0 million of existing debt from the Company’s

revolving credit facility. The additional $50.0 million of proceeds were primarily used to fund the Jean Louis David acquisition, which was

completed in April of 2002.

The equipment and leasehold notes payable are primarily comprised of capital lease obligations totaling $7.2 and $4.0 million at June 30, 2003

and 2002, respectively. These capital lease obligations are payable in monthly installments through 2008.

All of the Company’s debt instruments are unsecured, except for its capital lease obligations which are collateralized by the assets purchased

under the agreement.

The debt agreements contain covenants, including limitations on incurrence of debt, granting of liens, investments, merger or consolidation,

and transactions with affiliates. In addition, the Company must not exceed specified fixed charge coverage, leverage and debt-to-capitalization

ratios.

As a result of the fair value hedging activities discussed in Note 5, an adjustment of approximately $8.5 and $2.3 million were made to increase

the carrying value of the Company’s long-term fixed rate debt at June 30, 2003 and 2002, respectively. Therefore, at June 30, 2003 and 2002,

approximately 34 and 47 percent of the Company’s fixed rate debt has been marked to market, respectively. Considering the mark-to-market

adjustment and current market interest rates, the carrying values of the Company’s debt instruments, based upon discounted cash flow analyses

using the Company’s current incremental borrowing rate, approximate their fair values at June 30, 2003 and 2002.

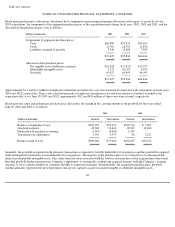

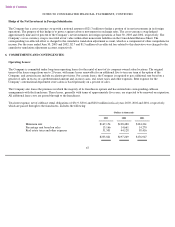

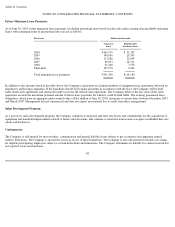

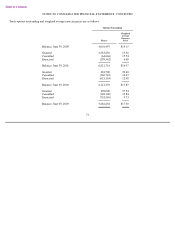

Aggregate maturities of long-term debt, including associated fair value hedge obligations of $8.5 million and capital lease obligations of

$7.2 million at June 30, 2003, are as follows:

64

Fiscal year (Dollars in thousands)

2004

$

21,123

2005

15,937

2006

15,160

2007

53,046

2008

20,867

Thereafter

175,624

$

301,757