Supercuts 2003 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2003 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

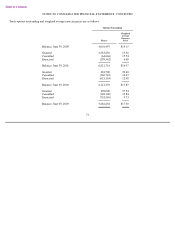

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

63

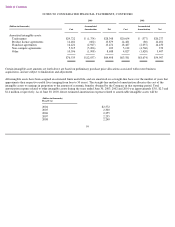

The Company has guaranteed that stock issued in certain acquisitions will reach a certain market price. If the stock should not reach this

price during the agreed-upon time frame (typically three years from the date of acquisition), the Company is obligated to issue additional

shares to the sellers. Once the agreed-upon stock price is met or exceeded for a period of five consecutive days, the contingency is met and

the Company is no longer liable. Based on the June 30, 2003 market price, the Company would be required to provide an additional 139,248

shares related to these acquisition contingencies if the agreed-upon time frames were all assumed to have expired June 30, 2003. These

contingently issuable shares have been included in the calculation of diluted earnings per share for the year ended June 30, 2003.

4.

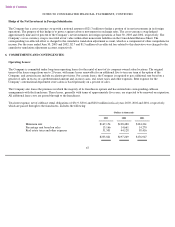

FINANCING ARRANGEMENTS:

The Company

’

s long

-

term debt as of June 30, 2003 and 2002 consists of the following:

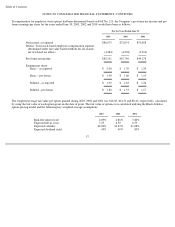

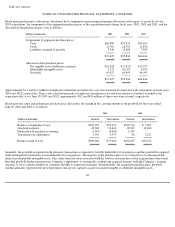

(Dollars in thousands)

Interest rate % Amounts outstanding

Maturity

Dates

2003

2002

2003

2002

Senior term notes

2004

-

2013

4.69

-

8.39

6.55

-

8.39

$

269,478

$

237,711

Revolving credit facilities

2007

2.34

-

5.06

2.68

-

8.23

22,775

55,000

Equipment and leasehold notes payable

2004

-

2008

9.21

-

11.56

7.57

-

11.56

7,726

4,047

Other notes payable

2004

-

2009

5.00

-

11.50

5.00

-

10.00

1,778

2,258

301,757

299,016

Less current portion

(21,123

)

(7,221

)

Long

-

term portion

$

280,634

$

291,795

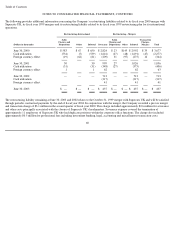

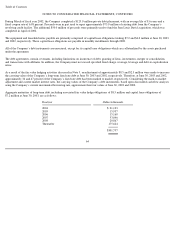

During the second quarter of fiscal year 2003, the Company extended its revolving credit facility through November of fiscal year 2006. The

facility bears interest at the prime rate or LIBOR plus 112.5 to 137.5 basis points. The prime rate at June 30, 2003 and 2002 was 4.00 and

4.75 percent, respectively. The three-month LIBOR rate at June 30, 2003 and 2002 was 1.11 and 1.86 percent, respectively. The revolving

credit facility requires a quarterly fee related to the unused portion of the facility at 27.5 to 32.5 basis points. The LIBOR credit spread and

unused fee are based on the Company’s debt-to-EBITDA ratio at the end of each fiscal quarter. The facility is used for short-term financing

of new salon and acquisition growth as well as to finance the general working capital requirements of the Company.

In the third quarter of fiscal year 2003, the Company renewed one of its private placement debt facilities, thereby extending its terms

through October 1, 2005 and increasing its related borrowing capacity from $125.0 to $246.0 million. No other significant changes were

made to either of the facilities

’

terms.

In June 2003, the Company borrowed $30.0 million under a 4.69 percent senior term note due June 2013 to repay existing debt from the

Company

’

s revolving credit facility.