Supercuts 2003 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2003 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

SUMMARY

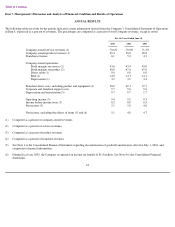

Regis Corporation, based in Minneapolis, Minnesota, is the world’

s largest owner, operator and franchisor of hair and retail product salons. The

Regis worldwide operations include 9,617 domestic and international salons at June 30, 2003. Each of the Company’s concepts have generally

similar products and services. The Company is organized to manage its operations based on geographical location. The Company’s domestic

operations includes 7,591 salons, including 2,427 franchised salons, operating primarily under the trade names of Regis Salons, MasterCuts,

Trade Secret, SmartStyle, Supercuts and Cost Cutters. The Company’s international operations include 2,026 salons, including 1,627

franchised salons, located throughout Europe, primarily in the United Kingdom, France, Italy and Spain. The Company has approximately

49,000 employees worldwide.

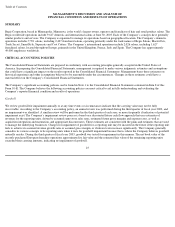

CRITICAL ACCOUNTING POLICIES

The Consolidated Financial Statements are prepared in conformity with accounting principles generally accepted in the United States of

America. In preparing the Consolidated Financial Statements, management is required to make various judgments, estimates and assumptions

that could have a significant impact on the results reported in the Consolidated Financial Statements. Management bases these estimates on

historical experience and other assumptions believed to be reasonable under the circumstances. Changes in these estimates could have a

material effect on the Company’s Consolidated Financial Statements.

The Company’s significant accounting policies can be found in Note 1 to the Consolidated Financial Statements contained in Item 8 of this

Form 10-K. The Company believes the following accounting policies are most critical to aid in fully understanding and evaluating the

Company’s reported financial condition and results of operations.

Goodwill

We review goodwill for impairment annually or at any time events or circumstances indicate that the carrying value may not be fully

recoverable. According to the Company’s accounting policy, an annual review was performed during the third quarter of fiscal year 2003, and

no impairment was identified. A similar review will be performed in the third quarter of each year, or more frequently if indicators of potential

impairment exist. The Company’s impairment review process is based on a discounted future cash flow approach that uses estimates of

revenues for the reporting units, driven by assumed same-store sales rates, estimated future gross margins and expense rates, as well as

acquisition integration and maturation, and appropriate discount rates. These estimates are consistent with the plans and estimates that are used

to manage the underlying businesses. Charges for impairment of goodwill for a reporting unit may be incurred in the future if the reporting unit

fails to achieve its assumed revenue growth rates or assumed gross margin, or if interest rates increase significantly. The Company generally

considers its various concepts to be reporting units when it tests for goodwill impairment because that is where the Company believes goodwill

naturally resides. During the third quarter of fiscal year 2003, goodwill was tested for impairment in this manner. The net book value of the

recently purchased European franchise operations approximated its fair value and the estimated fair value of the remaining reporting units

exceeded their carrying amounts, indicating no impairment of goodwill.

25