Supercuts 2003 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2003 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

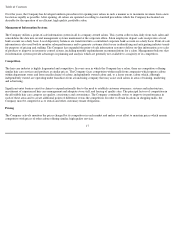

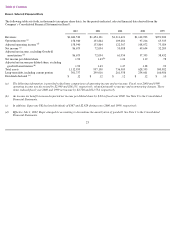

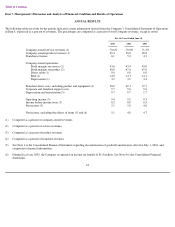

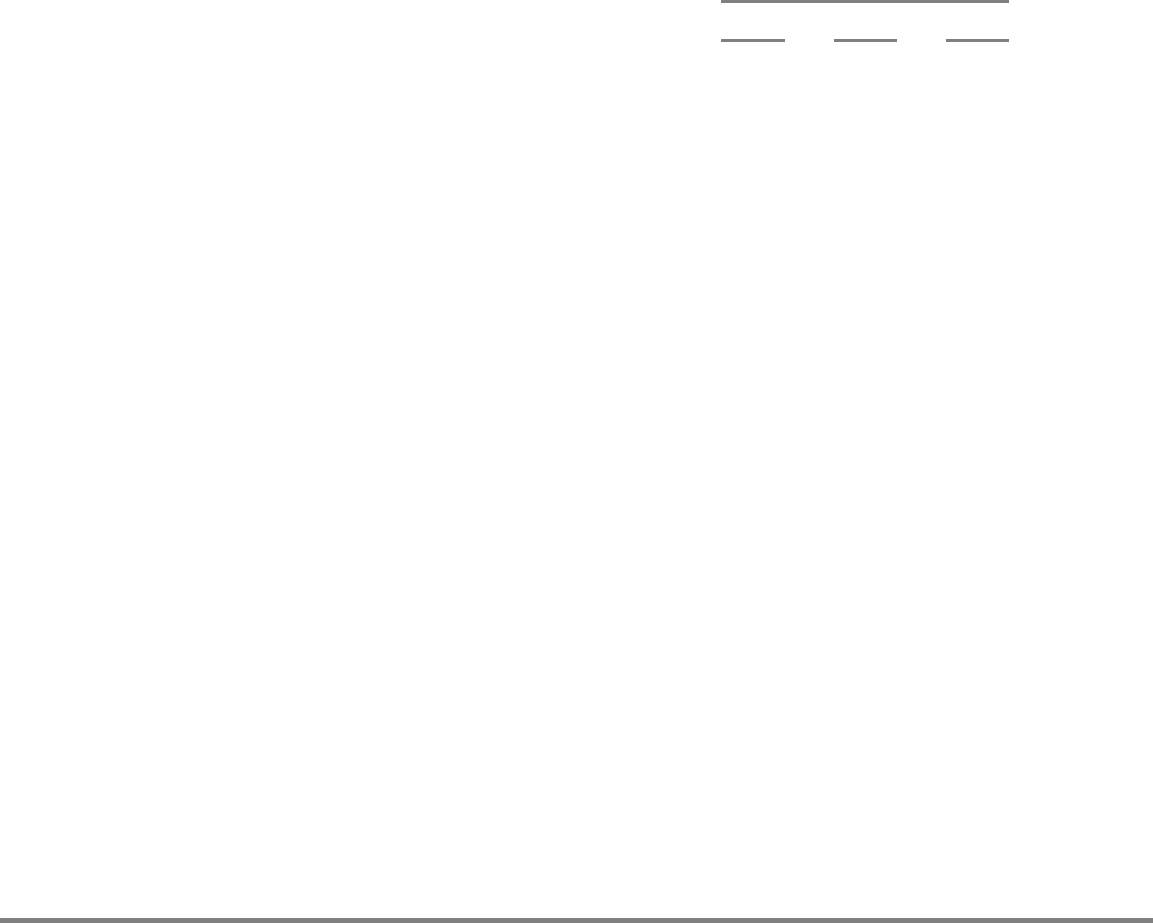

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

ANNUAL RESULTS

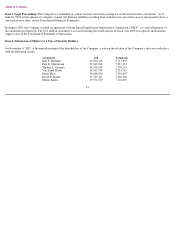

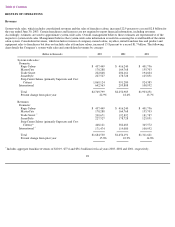

The following table sets forth for the periods indicated certain information derived from the Company’s Consolidated Statement of Operations

in Item 8. expressed as a percent of revenues. The percentages are computed as a percent of total Company revenues, except as noted.

24

For the Years Ended June 30,

2003 2002 2001

Company

-

owned service revenues (1)

70.6

%

70.0

%

71.2

%

Company

-

owned product revenues (1)

29.4

30.0

28.8

Franchise revenues

6.1

5.3

4.3

Company

-

owned operations:

Profit margins on service (2)

43.6

43.4

43.0

Profit margins on product (3)

50.0

47.6

47.0

Direct salon (1)

9.0

9.0

9.0

Rent (1)

14.8

14.3

14.1

Depreciation (1)

3.5

3.5

3.4

Franchise direct costs, including product and equipment (4)

56.0

49.1

37.7

Corporate and franchise support costs

9.7

9.6

9.6

Depreciation and amortization (5)

0.7

0.7

1.7

Operating income (5)

9.4

9.2

8.3

Income before income taxes (5)

8.2

8.0

6.8

Net income (5)

5.1

5.0

4.0

Net income, excluding the effects of items (5) and (6)

5.1

4.8

4.7

(1)

Computed as a percent of company

-

owned revenues.

(2)

Computed as a percent of service revenues.

(3)

Computed as a percent of product revenues.

(4)

Computed as a percent of franchise revenues.

(5)

See Note 1 to the Consolidated Financial Statements regarding discontinuation of goodwill amortization, effective July 1, 2001, and

comparative financial information.

(6)

During fiscal year 2002, the Company recognized an income tax benefit of $1.8 million. See Note 8 to the Consolidated Financial

Statements.