Supercuts 2003 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2003 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

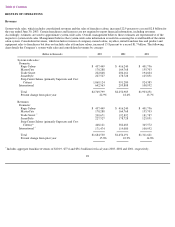

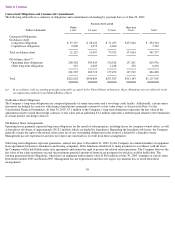

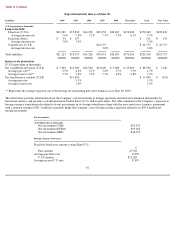

Contractual Obligations and Commercial Commitments

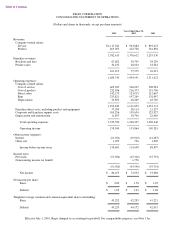

The following table reflects a summary of obligations and commitments outstanding by payment date as of June 30, 2003:

On-Balance Sheet Obligations

The Company’s long-term obligations are composed primarily of senior term notes and a revolving credit facility. Additionally, certain senior

term notes are hedged by contracts with financial institutions commonly referred to as fair value swaps, as discussed in Note 5 to the

Consolidated Financial Statements. At June 30, 2003, $7.1 million of the Company’s long-term obligations represents the fair value of the

adjustments made to mark these hedge contracts to fair value and an additional $1.4 million represents a deferred gain related to the termination

of certain interest rate hedge contracts.

Off-Balance Sheet Arrangements

Operating leases primarily represent long-term obligations for the rental of salon premises, including leases for company-

owned salons, as well

as franchisee sub-leases of approximately $118.2 million, which are funded by franchisees. Regarding the franchisee sub-leases, the Company

generally retains the right to the related salon assets net of any outstanding obligations in the event of a default by a franchise owner.

Management has not experienced and does not expect any material loss to result from these arrangements.

Other long-term obligations represent guarantees, entered into prior to December 31, 2002, by the Company on a limited number of equipment

lease agreements between its franchisees and leasing companies. If the franchisee should fail to make payments in accordance with the lease,

the Company will be held liable under such agreements and retains the right to possess the related salon operations. The Company believes the

fair value of the salon operations exceeds the maximum potential amount of future lease payments for which it could be held liable. The

existing guaranteed lease obligations, which have an aggregate undiscounted value of $6.6 million at June 30, 2003, terminate at various dates

between December 2003 and March 2009. Management has not experienced and does not expect any material loss to result from these

arrangements.

36

Payments due by period

Within

More than

(Dollars in thousands) 1 year 1-3 years 3-5 years 5 years Total

Contractual Obligations

On

-

balance sheet:

Long

-

term obligations

$

19,115

$

28,122

$

71,653

$

175,624

$

294,514

Capital lease obligations

2,008

2,975

2,260

7,243

Total on

-

balance sheet

21,123

31,097

73,913

175,624

301,757

Off-balance sheet

(a) :

Operating lease obligations

200,582

305,429

176,324

137,241

819,576

Other long

-

term obligations

923

4,283

1,148

278

6,632

201,505

309,712

177,472

137,519

826,208

Total

$

222,628

$

340,809

$

251,385

$

313,143

$

1,127,965

(a)

In accordance with accounting principles generally accepted in the United States of America, these obligations are not reflected in the

accompanying audited Consolidated Balance Sheet.