Supercuts 2003 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2003 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

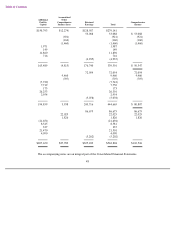

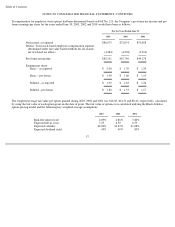

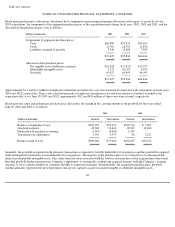

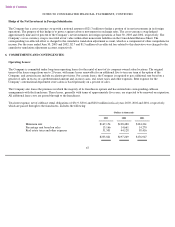

2. OTHER FINANCIAL STATEMENT DATA

The following provides additional information concerning selected balance sheet accounts as of June 30, 2003 and 2002:

58

(Dollars in thousands)

2003

2002

Accounts receivable

$

35,633

$

28,738

Less allowance for doubtful accounts

(3,686

)

(1,837

)

$

31,947

$

26,901

Property and equipment:

Land

$

3,817

$

3,817

Buildings and improvements

38,113

29,518

Equipment, furniture and leasehold improvements

535,476

479,662

Internal use software

41,790

44,186

Equipment, furniture and leasehold improvements under capital

leases

22,147

15,135

641,343

572,318

Less accumulated depreciation and amortization

(273,059

)

(243,888

)

Less amortization of equipment, furniture and leasehold

improvements under capital leases

(11,559

)

(9,948

)

$

356,725

$

318,482

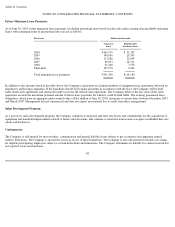

Accounts payable:

Book overdrafts payable

$

5,179

$

8,680

Other accounts payable

50,996

45,865

$

56,175

$

54,545

Accrued expenses:

Payroll and payroll related costs

$

45,388

$

38,580

Insurance

26,446

20,252

Taxes payable, primarily income taxes

13,309

3,605

Book overdrafts payable

3,540

3,189

Acquisition purchase price payable

877

9,771

Restructuring

679

1,489

Other

31,528

20,637

$

121,767

$

97,523

Other noncurrent liabilities:

Deferred income taxes

$

26,472

$

29,813

Deferred rent payable

10,242

9,221

Other

33,738

22,407

$

70,452

$

61,441