Starbucks 2000 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2000 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

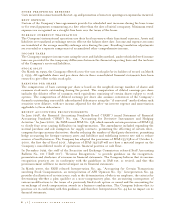

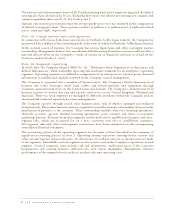

The Internet-related investment losses of 58.8 million during fiscal 2000 negatively impacted the diluted

earnings per share calculation by $0.22. Excluding these losses, the diluted net earnings per common and

common equivalent share was $0.71. See Notes 4 and 7.

Options with exercise prices greater than the average market price were not included in the computation

of diluted earnings per share. These options totaled 0.3 million, 0.6 million and 0.3 million for fiscal

2000, 1999 and 1998, respectively.

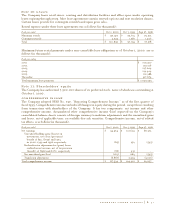

Note 15: Commitments and contingencies

In connection with various bank loans entered into by Starbucks Coffee Japan Limited, the Company has

guaranteed $25.4 million of the outstanding debt in the event of default by Starbucks Coffee Japan Limited.

In the normal course of business, the Company has various legal claims and other contingent matters

outstanding. Management believes that any ultimate liability arising from these actions would not have a

material adverse effect on the Company’s results of operations or financial condition as of and for the

fiscal year ended October 1, 2000.

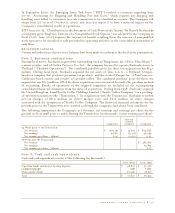

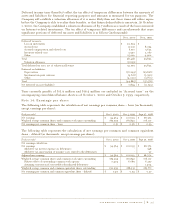

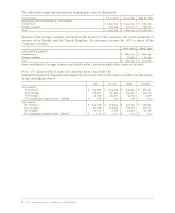

Note 16: Segment reporting

In fiscal 1999, the Company adopted SFAS No. 131, “Disclosures about Segments of an Enterprise and

Related Information,” which establishes reporting and disclosure standards for an enterprise’s operating

segments. Operating segments are defined as components of an enterprise for which separate financial

information is available and regularly reviewed by the Company’s senior management.

The Company is organized into a number of business units. The Company’s North American retail

business sells coffee beverages, whole bean coffees and related hardware and equipment through

Company-operated retail stores in the United States and Canada. The Company’s international retail

business consists of entities that own and operate retail stores in the United Kingdom, Thailand and

Australia. These two retail segments are managed by different presidents within the Company and are

measured and evaluated separately by senior management.

The Company operates through several other business units, each of which is managed and evaluated

independently. These other business units are organized around the strategic relationships that govern the

distribution of products to the customer. These relationships include retail store licensing agreements,

wholesale accounts, grocery channel licensing agreements, joint ventures and direct-to-consumer

marketing channels. Revenues from these segments include both sales to unaffiliated customers and inter-

segment sales, which are accounted for on a basis consistent with sales to unaffiliated customers.

Intersegment sales and other intersegment transactions have been eliminated on the accompanying

consolidated financial statements.

The accounting policies of the operating segments are the same as those described in the summary of

significant accounting policies in Note 1. Operating income represents earnings before interest and

other income/expense and income taxes. No allocations of overhead, interest or income taxes are made

to the segments. Identifiable assets by segment are those assets used in the Company’s operations in each

segment. General corporate assets include cash and investments, unallocated assets of the corporate

headquarters and roasting facilities, deferred taxes and certain intangibles. Management evaluates

performance of the segments based on direct product sales and operating costs.

P. 46 starbucks coffee company