Starbucks 2000 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2000 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

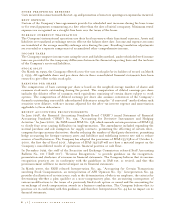

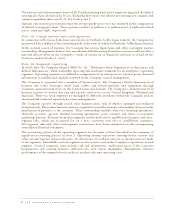

Deferred income taxes (benefits) reflect the tax effect of temporary differences between the amounts of

assets and liabilities for financial reporting purposes and amounts as measured for tax purposes. The

Company will establish a valuation allowance if it is more likely than not these items will either expire

before the Company is able to realize their benefits, or that future deductibility is uncertain. At October

1, 2000, the Company established a valuation allowance of $5.7 million as a result of the losses incurred

on Internet-related investments. The tax effect of temporary differences and carryforwards that cause

significant portions of deferred tax assets and liabilities is as follows (in thousands):

Oct 1, 2000 Oct 3, 1999

Deferred tax assets:

Loss on investments $ 22,635 $ -

Accrued rent 10,321 8,234

Accrued compensation and related costs 6,710 5,622

Inventory related costs 3,550 2,067

Other 15,222 9,900

Total 58,438 25,823

Valuation allowance (5,659) -

Total deferred tax asset, net of valuation allowance 52,779 25,823

Deferred tax liabilities:

Depreciation (36,249) (29,826)

Investments in joint ventures (4,616) (3,990)

Other (4,020) (3,760)

Total (44,885) (37,576)

Net deferred tax asset (liability) $ 7,894 $ (11,753)

Taxes currently payable of $17.9 million and $16.3 million are included in “Accrued taxes” on the

accompanying consolidated balance sheets as of October 1, 2000 and October 3, 1999, respectively.

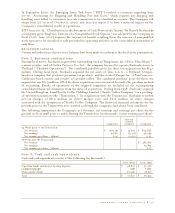

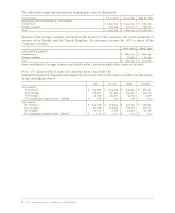

Note 14: Earnings per share

The following table represents the calculation of net earnings per common share – basic (in thousands,

except earnings per share):

Fiscal year ended Oct 1, 2000 Oct 3, 1999 Sept 27, 1998

Net earnings $ 94,564 $ 101,693 $ 68,372

Weighted average common shares and common stock units outstanding 185,595 181,842 176,110

Net earnings per common share - basic $ 0.51 $ 0.56 $ 0.39

The following table represents the calculation of net earnings per common and common equivalent

share - diluted (in thousands, except earnings per share):

Fiscal year ended Oct 1, 2000 Oct 3, 1999 Sept 27, 1998

Net earnings calculation:

Net earnings $ 94,564 $ 101,693 $ 68,372

Add after-tax interest expense on debentures - - 348

Add after-tax amortization of issuance costs related to the debentures - - 30

Adjusted net earnings $ 94,564 $ 101,693 $ 68,750

Weighted average common shares and common stock units outstanding 185,595 181,842 176,110

Dilutive effect of outstanding common stock options 7,404 6,689 6,257

Assuming conversion of convertible subordinated debentures - - 1,404

Weighted average common and common equivalent shares outstanding 192,999 188,531 183,771

Net earnings per common and common equivalent share - diluted $ 0.49 $ 0.54 $ 0.37

starbucks coffee company P. 45