Starbucks 2000 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2000 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

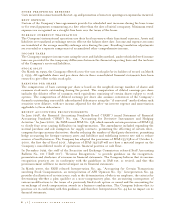

Seasonality and Quarterly Results

The Company’s business is subject to seasonal fluctuations. Significant portions of the Company’s net

revenues and profits are realized during the first quarter of the Company’s fiscal year, which includes the

December holiday season. In addition, quarterly results are affected by the timing of the opening of new

stores, and the Company’s rapid growth may conceal the impact of other seasonal influences. Because of

the seasonality of the Company’s business, results for any quarter are not necessarily indicative of the

results that may be achieved for the full fiscal year.

New Accounting Standards

In June 1998, the Financial Accounting Standards Board (“FASB”) issued Statement of Financial

Accounting Standards (“SFAS”) No. 133, “Accounting for Derivative Instruments and Hedging

Activities.” In June 2000, the FASB issued SFAS No. 138, which amends certain provisions of SFAS 133

to clarify four areas causing difficulties in implementation. The amendment included expanding

the normal purchase and sale exemption for supply contracts, permitting the offsetting of certain

intercompany foreign currency derivatives, thereby reducing the number of third party derivatives,

permitting hedge accounting for foreign-currency assets and liabilities and redefining interest rate risk

to reduce sources of ineffectiveness. The Company has adopted the provisions of SFAS 133/138 as of

October 2, 2000, the first day of fiscal 2001. Adoption of SFAS 133/138 will not have a material impact

on the Company’s consolidated results of operations, financial position or cash flows.

In December 1999, the staff of the Securities and Exchange Commission released Staff Accounting

Bulletin No. 101 (“SAB 101”), “Revenue Recognition,” to provide guidance on the recognition,

presentation and disclosure of revenues in financial statements. The Company believes that its revenue

recognition practices are in conformity with the guidelines in SAB 101, as revised, and that this

pronouncement will have no material impact on its financial statements.

In March 2000, the FASB released Interpretation No. 44, “Accounting for Certain Transactions

involving Stock Compensation: an interpretation of APB Opinion No. 25.” Interpretation No. 44

provides clarification of certain issues, such as the determination of who is an employee, the criteria for

determining whether a plan qualifies as a non-compensatory plan, the accounting consequence of

various modifications to the terms of a previously fixed stock option or award and the accounting for an

exchange of stock compensation awards in a business combination. The Company believes that its

practices are in conformity with this guidance, and therefore Interpretation No. 44 has no impact on its

financial statements.

In September 2000, the Emerging Issues Task Force (“EITF”) reached a consensus regarding Issue

00-10, “Accounting for Shipping and Handling Fees and Costs,” which requires any shipping and

handling costs billed to customers in a sale transaction to be classified as revenue. The Company will adopt

Issue 00-10 as of October 2, 2000, and does not expect it to have a material impact on the Company’s

consolidated results of operations.

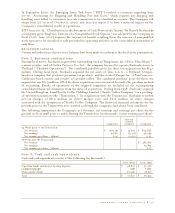

EITF Issue 00-15, “Classification in the Statement of Cash Flows of the Income Tax Benefit Realized by

a Company upon Employee Exercise of a Nonqualified Stock Option,” was adopted by the Company in

fiscal 2000. Issue 00-15 requires the income tax benefit resulting from the exercise of nonqualified

stock options to be classified as cash provided by operating activities in the consolidated statements of

cash flows.

starbucks coffee company P. 29