Starbucks 2000 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2000 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

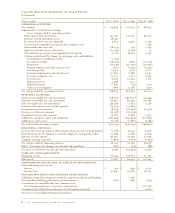

Notes to Consolidated Financial Statements

Years ended October 1, 2000, October 3, 1999 and September 27, 1998

Note 1: Summary of significant accounting policies

description of business

Starbucks Corporation and its subsidiaries (collectively “Starbucks” or the “Company”) purchases and

roasts high quality whole bean coffees and sells them, along with fresh, rich-brewed coffees, Italian-style

espresso beverages, cold blended beverages, a variety of pastries and confections, coffee-related

accessories and equipment and a line of premium teas, primarily through its Company-operated retail

stores. In addition to sales through its Company-operated retail stores, Starbucks sells coffee and tea

products through other channels of distribution (collectively, “specialty operations”). Starbucks, through

its joint venture partnerships, also produces and sells bottled Frappuccino®coffee drink and a line of

premium ice creams. The Company’s objective is to establish Starbucks as the most recognized and

respected brand in the world. To achieve this goal, the Company plans to continue to rapidly expand

its retail operations, grow its specialty operations and selectively pursue other opportunities to leverage

the Starbucks brand through the introduction of new products and the development of new

distribution channels.

principles of consolidation

The consolidated financial statements reflect the financial position and operating results of Starbucks,

its subsidiaries and investments in joint ventures in which the Company has significant control. All

significant intercompany transactions have been eliminated.

The Company has investments in unconsolidated joint ventures that are accounted for under the equity

method, as the Company does not exercise control over the operating and financial policies of such joint

ventures. The Company also has other investments that are accounted for under the cost method.

fiscal year-end

The Company’s fiscal year ends on the Sunday closest to September 30. The fiscal years ended October

1, 2000 and September 27, 1998 each included 52 weeks. The fiscal year ended October 3, 1999,

included 53 weeks.

estimates and assumptions

The preparation of financial statements in conformity with accounting principles generally accepted in

the United States of America requires management to make estimates and assumptions that affect the

reported amounts of assets, liabilities, revenues and expenses. Actual results may differ from these estimates.

cash and cash equivalents

The Company considers all highly liquid instruments with a maturity of three months or less at the time

of purchase to be cash equivalents.

cash management

The Company’s cash management system provides for the reimbursement of all major bank disbursement

accounts on a daily basis. Checks issued but not presented for payment to the bank are reflected as “Checks

drawn in excess of bank balances” on the accompanying consolidated financial statements.

short-term investments

The Company’s investments consist primarily of investment-grade marketable debt and equity securities,

all of which are classified as trading or available-for-sale. Trading securities are recorded at fair value with

unrealized holding gains and losses included in earnings. Available-for-sale securities are recorded at fair

value, and unrealized holding gains and losses are recorded, net of tax, as a separate component of

accumulated other comprehensive income. Unrealized losses are charged against net earnings when a

decline in fair value is determined to be other than temporary. Realized gains and losses are accounted for

on the specific identification method. Purchases and sales are recorded on a trade date basis.

P. 34 starbucks coffee company