Starbucks 2000 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2000 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In addition to fluctuating coffee prices, management believes that the Company’s future results of

operations and earnings could be significantly impacted by other factors such as increased competition

within the specialty coffee industry, the Company’s ability to find optimal store locations at favorable

lease rates, increased costs associated with opening and operating retail stores and the Company’s

continued ability to hire, train and retain qualified personnel.

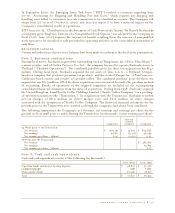

Financial Risk Management

The Company is exposed to market risk related to changes in interest rates, equity security prices and

foreign currency exchange rates.

interest rate risk

The Company’s available-for-sale portfolio consists mainly of diversified fixed income instruments with

average maturities of three months. The primary objectives of these investments are to preserve capital

and liquidity without significantly increasing risk to the Company. Available-for-sale securities are of

investment grade and are recorded on the balance sheet at fair value with unrealized gains and losses

reported as a separate component of accumulated other comprehensive income. As of October 1, 2000,

this portfolio comprised 98% of “Short-term investments” on the accompanying consolidated balance

sheet. The Company does not hedge its interest rate exposure.

equity security price risk

The Company has minimal exposure to price fluctuations on equity mutual funds within the trading

portfolio, which comprised the remaining 2% of “Short-term investments” on the accompanying

consolidated balance sheet as of October 1, 2000. The trading securities are designated to approximate

the Company’s liability under the Management Deferred Compensation Plan (“MDCP”). A corresponding

liability is included in “Accrued compensation and related costs” on the accompanying consolidated

balance sheets. These investments are recorded at fair value with unrealized gains and losses

recognized in “Interest and other income, net.” The offsetting changes in the MDCP liability are recorded

in “General and administrative expenses” on the accompanying consolidated statements of earnings.

The Company also has equity investments in privately held Internet-related companies. These investments

are inherently risky as the products and services supplied by these companies could be considered in the

start-up or development stages and may never materialize. The Company could lose its entire investment

in these companies. During fiscal 2000, the Company recorded other-than-temporary write-downs of

$59 million. These investments are recorded on the accompanying consolidated balance sheet at a fair

value of $5 million as of October 1, 2000.

foreign currency exchange risk

The majority of the Company’s revenue, expense and capital purchasing activities are transacted in

United States dollars. However, because a portion of the Company’s operations consists of activities

outside of the United States, the Company has transactions in other currencies, primarily the Canadian

dollar, British pound and Japanese yen. Historically, this exposure has had a minimal impact on

the Company.

The Company did not hedge foreign currency risk or engage in any other hedging transactions during

fiscal 2000, 1999 or 1998. The Company has entered into forward foreign exchange contracts to hedge

foreign currency risk in fiscal 2001.

P. 28 starbucks coffee company