Starbucks 2000 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2000 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

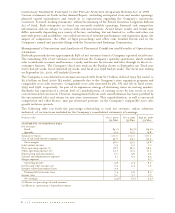

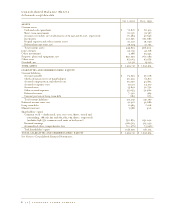

Gross Margin

Gross margin increased to 55.9% for fiscal 1999 from 55.8% in fiscal 1998. The positive impact on gross

margin of lower green coffee costs was partially offset by lower gross margins associated with a change in

the Company’s strategy for the grocery channel. In late fiscal 1998, the Company signed a long-term

licensing agreement with Kraft Foods, Inc. (“Kraft”) to handle the U.S. distribution, marketing and

advertising for Starbucks whole bean and ground coffee in grocery, warehouse club and mass merchandise

stores. The transition to Kraft occurred in the first quarter of fiscal 1999.

Joint Venture Income

Joint venture income was $3.2 million for fiscal 1999, compared to $1.0 million for fiscal 1998. The

increase was primarily due to the improved profitability from the North American Coffee Partnership

and from Starbucks Coffee Japan Limited.

Expenses

Store operating expenses as a percentage of retail sales increased to 38.2% for fiscal 1999 from 37.5%

for fiscal 1998, excluding costs associated with the Transaction. This was due primarily to higher payroll-

related expenditures resulting from both an increase in average hourly wage rates and a continuing shift

in sales to handcrafted beverages, which are more labor intensive. Including the Transaction costs, store

operating expenses for fiscal 1998 were 38.0% of retail sales.

Other operating expenses were 21.3% of specialty revenues during fiscal 1999, compared to 21.6% for

fiscal 1998. This decrease was attributable to lower operating expenses associated with the grocery channel

after the transition to Kraft, partially offset by higher payroll-related expense supporting other channels.

Depreciation and amortization was 5.8% of net revenues, compared to 5.5% of net revenues for fiscal

1998, primarily due to depreciation on new information systems put into service in late fiscal 1998 and

during fiscal 1999. General and administrative expenses were 5.3% of net revenues during fiscal 1999

compared to 5.9% for fiscal 1998, primarily due to proportionately lower payroll-related expenses.

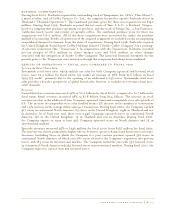

Income Taxes

The Company’s effective tax rate for fiscal 1999 was 38.0% compared to 41.2% for fiscal 1998. The

effective tax rate in fiscal 1998 was impacted by non-deductible losses of Seattle Coffee Company prior

to the Transaction. Fiscal 1998’s rate was also affected by Transaction-related costs.

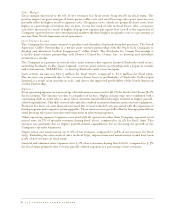

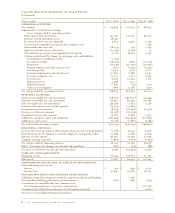

Liquidity and Capital Resources

The Company ended fiscal 2000 with $132.2 million in total cash and short-term investments. Working

capital as of October 1, 2000, totaled $146.6 million compared to $135.3 million as of October 3,

1999. Cash and cash equivalents increased by $4.4 million during fiscal 2000 to $70.8 million at

October 1, 2000. This increase was in addition to an increase in short-term investments of $10.0

million during the same period.

Cash provided by operating activities for fiscal 2000 totaled $318.6 million and resulted primarily

from net earnings of $299.0 million before non-cash charges. Accrued compensation and related costs

contributed $31.0 million, primarily due to accrued bonus increases resulting from the financial

performance of the Company’s core businesses. In addition, deferred revenue increased mainly from

the commercial agreement with Kozmo.com. Higher international accounts receivable, which are

generally outstanding for longer periods of time than domestic receivables, and higher receivables from

licensees resulted in an increased use of cash.

P. 26 starbucks coffee company