Starbucks 2000 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2000 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

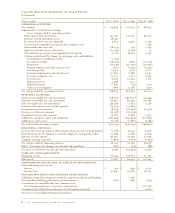

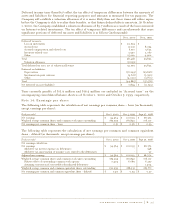

Note 7: Other investments

In fiscal 1999, the Company invested $20.3 million in living.com Inc. (“living.com”), an online furniture

retailer. Also in 1999, the Company established an alliance with Cooking.com, Inc. (“Cooking.com”), a

privately held web-based retailer of cookware, accessories and specialty foods and provider of information

about cooking. As part of this alliance, the Company made a $10.0 million investment in Cooking.com.

During fiscal 2000, the Company invested $25.0 million in Kozmo.com, an Internet-to-door delivery

service for food, entertainment and convenience items. Starbucks and Kozmo.com also entered into a

commercial agreement to provide in-store return boxes in Starbucks stores in exchange for cash, a

channel for selling the Company’s products and other marketing opportunities. In connection with this

agreement, Starbucks received a $15.0 million payment that is being recognized as revenue on a straight-

line basis over twelve months. The Company does not expect to continue recording revenue from the

current Kozmo.com relationship after February 2001.

During fiscal 2000, the Company determined that its investments in Internet-related companies had

suffered declines in value that were other than temporary. As a result, the Company recognized losses

totaling $52.0 million to reduce its investments in living.com, Cooking.com and Kozmo.com to their

aggregate fair value of $3.6 million as of October 1, 2000.

The Company also had various other investments recorded at their estimated aggregate fair value of $0.2

million as of October 1, 2000.

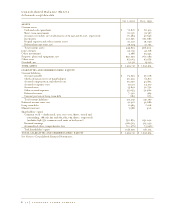

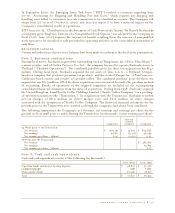

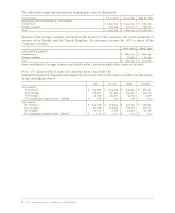

Note 8: Property, plant and equipment

Property, plant and equipment are recorded at cost and consist of the following (in thousands):

Oct 1, 2000 Oct 3, 1999

Land $ 5,084 $ 5,084

Building 19,795 19,795

Leasehold improvements 736,471 591,640

Roasting and store equipment 369,587 273,612

Furniture, fixtures and other 182,528 130,223

1,313,465 1,020,354

Less accumulated depreciation and amortization (446,403) (320,982)

867,062 699,372

Work in progress 63,697 60,917

Property, plant and equipment, net $ 930,759 $ 760,289

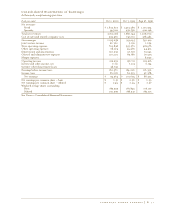

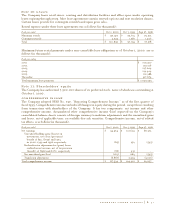

Note 9: Long-term debt

In September 1999, the Company purchased the land and building comprising its York County,

Pennsylvania roasting plant and distribution facility. The total purchase price was $12.9 million. In

connection with this purchase, the Company assumed loans totaling $7.7 million from the York County

Industrial Development Corporation. The remaining maturities of these loans range from 9 to 10 years,

with interest rates from 0.0% to 2.0%.

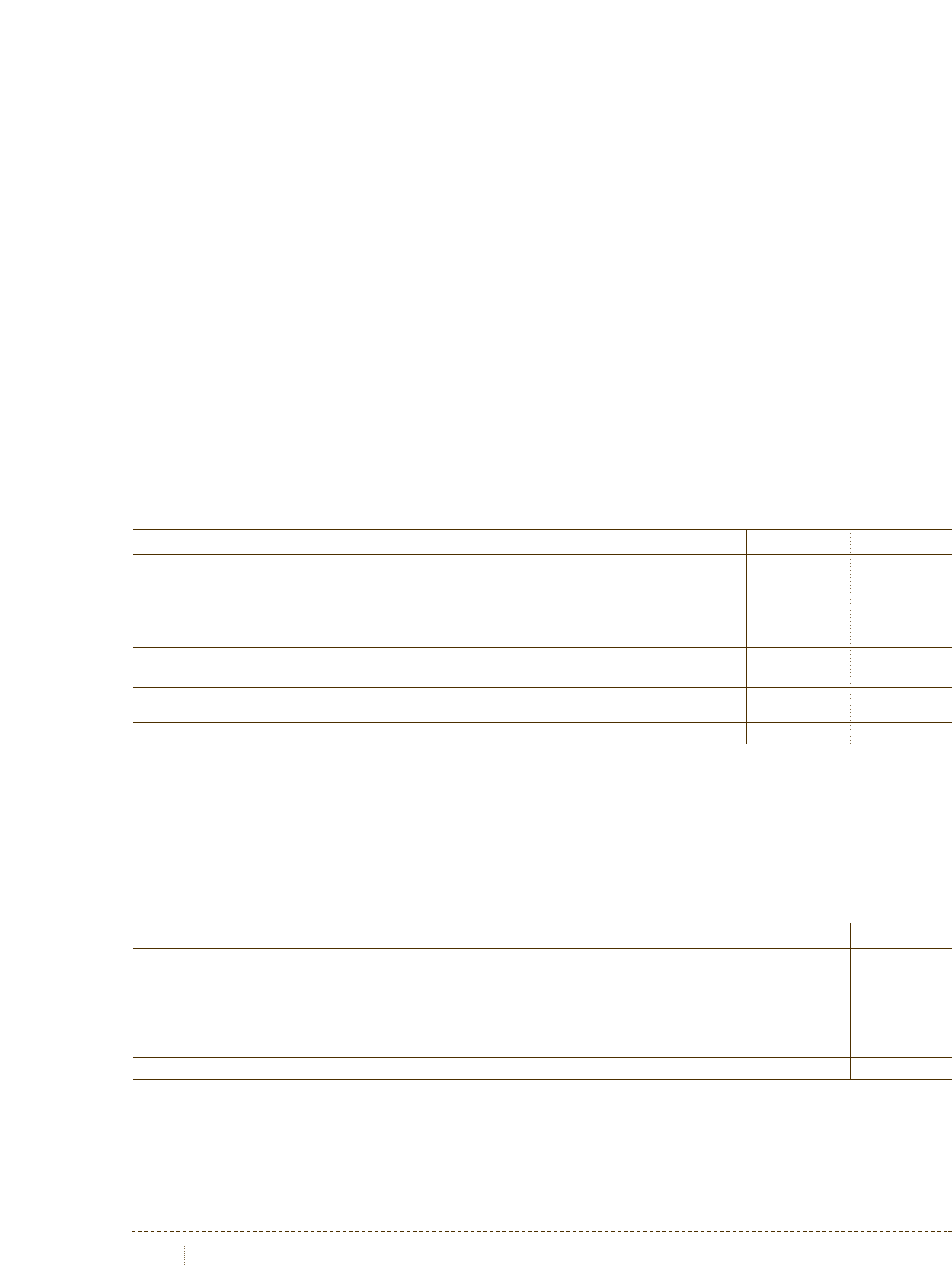

Scheduled principal payments on long-term debt are as follows (in thousands):

Fiscal year ending

2001 $ 685

2002 697

2003 710

2004 722

2005 735

Thereafter 3,619

Total principal payments $ 7,168

P. 40 starbucks coffee company