Starbucks 2000 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2000 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In September 2000, the Emerging Issues Task Force (“EITF”) reached a consensus regarding Issue

00-10, “Accounting for Shipping and Handling Fees and Costs,” which requires any shipping and

handling costs billed to customers in a sale transaction to be classified as revenue. The Company will

adopt Issue 00-10 as of October 2, 2000, and does not expect it to have a material impact on the

Company’s consolidated results of operations.

EITF Issue 00-15, “Classification in the Statement of Cash Flows of the Income Tax Benefit Realized by

a Company upon Employee Exercise of a Nonqualified Stock Option,” was adopted by the Company in

fiscal 2000. Issue 00-15 requires the income tax benefit resulting from the exercise of nonqualified

stock options to be classified as cash provided by operating activities in the consolidated statements of

cash flows.

reclassifications

Certain reclassifications of prior years’ balances have been made to conform to the fiscal 2000 presentation.

Note 2: Business combinations

During fiscal 2000, Starbucks acquired the outstanding stock of Tympanum, Inc. (d/b/a “Hear Music”),

a music retailer, and of Coffee Partners Co. Ltd., the company licensed to operate Starbucks stores in

Thailand (“Thailand Operations”). The combined purchase price for these two acquisitions was $14.1

million. During fiscal 1999, Starbucks acquired the net assets of Tazo, L.L.C., a Portland, Oregon-

based tea company that produces premium tea products, and the stock of Pasqua Inc., a San Francisco,

California-based roaster and retailer of specialty coffee. The combined purchase price for these two

acquisitions was $16.5 million. All of the above acquisitions were accounted for under the purchase method

of accounting. Results of operations of the acquired companies are included on the accompanying

consolidated financial statements from the dates of acquisition. During fiscal 1998, Starbucks acquired

the United Kingdom-based Seattle Coffee Holdings Limited (“Seattle Coffee Company”) in a pooling-

of-interests transaction (the “Transaction”). In conjunction with the Transaction, Starbucks recorded

pre-tax charges of $8.9 million in direct merger costs and $6.6 million in other charges

associated with the integration of Seattle Coffee Company. The historical financial statements for the

periods prior to the Transaction were restated as though the companies had always been combined.

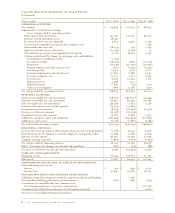

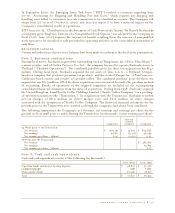

The following summarizes the Company’s net revenues, net earnings and earnings per share for the

periods in fiscal 1998 prior to and following the Transaction (in thousands, except earnings per share):

SEATTLE

COFFEE

STARBUCKS COMPANY COMBINED

34 Weeks prior to the Transaction:

Net revenues $ 805,151 $ 15,675 $ 820,826

Net earnings 45,811 (3,312) 42,499

Net earnings per share — diluted 0.25 (0.02) 0.23

18 Weeks after the Transaction:

Net revenues $ 487,876

Net earnings 25,873

Net earnings per share — diluted 0.15

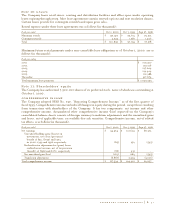

Note 3: Cash and cash equivalents

Cash and cash equivalents consist of the following (in thousands):

Oct 1, 2000 Oct 3, 1999

Operating funds and interest-bearing deposits $ 48,821 $ 39,926

Commercial paper 998 7,980

Money market funds 20,998 18,513

Total $ 70,817 $ 66,419

starbucks coffee company P. 37