Starbucks 2000 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2000 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

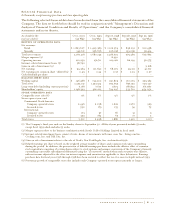

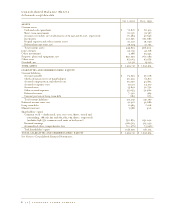

Cash used by investing activities for fiscal 2000 totaled $373.2 million. This included capital additions

to property, plant and equipment of $316.5 million related to opening 490 new Company-operated

retail stores, remodeling certain existing stores, enhancing information systems, purchasing roasting

and packaging equipment for the Company’s roasting and distribution facilities and expanding existing

office space. The Company also used $35.5 million primarily to make minority investments in

Kozmo.com and Cooking.com. The purchases of Hear Music and the Thailand operations used $13.5

million. The Company invested excess cash primarily in short-term, investment-grade marketable debt

securities. The net activity in the Company’s marketable securities portfolio during fiscal 2000 used

$10.5 million. During fiscal 2000, the Company made equity investments of $8.5 million in its

international joint ventures. The Company received $13.7 million in distributions from the North

American Coffee Partnership, $0.5 million in distributions from the Starbucks Ice Cream Partnership

and $0.1 million from its international joint ventures.

Cash provided by financing activities for fiscal 2000 totaled $59.4 million. This included $58.5

million generated from the exercise of employee stock options and $10.3 million generated from the

Company’s employee stock purchase plan. As options granted under the Company’s stock option plans

are exercised, the Company will continue to receive proceeds and a tax deduction; however, neither the

amounts nor the timing thereof can be predicted. Checks issued but not presented for payment used

$7.5 million.

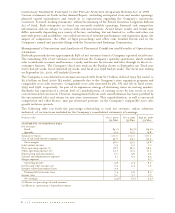

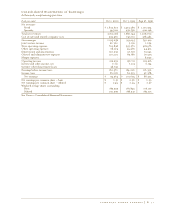

Cash requirements for fiscal 2001, other than normal operating expenses, are expected to consist

primarily of capital expenditures related to the addition of new Company-operated retail stores. The

Company plans to open at least 525 Company-operated stores during fiscal 2001. The Company also

anticipates incurring additional expenditures for remodeling certain existing stores and enhancing its

production capacity and information systems. While there can be no assurance that current expectations

will be realized, management expects capital expenditures for fiscal 2001 to be approximately

$390 million.

Management believes that existing cash and investments plus cash generated from operations should be

sufficient to finance capital requirements for its core businesses through fiscal 2001. New joint ventures,

other new business opportunities or store expansion rates substantially in excess of that presently

planned may require outside funding.

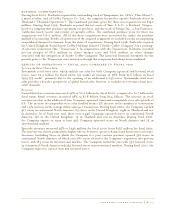

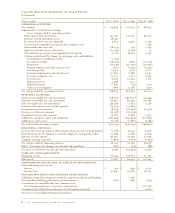

Coffee Prices, Availability and General Risk Conditions

The supply and price of coffee are subject to significant volatility. Although most coffee trades in the

commodity market, coffee of the quality sought by the Company tends to trade on a negotiated basis at

a substantial premium above commodity coffee prices, depending upon the supply and demand at the

time of purchase. Supply and price can be affected by multiple factors in the producing countries,

including weather, political and economic conditions. In addition, green coffee prices have been affected

in the past, and may be affected in the future, by the actions of certain organizations and associations

that have historically attempted to influence commodity prices of green coffee through agreements

establishing export quotas or restricting coffee supplies worldwide. The Company’s ability to raise sales

prices in response to rising coffee prices may be limited, and the Company’s profitability could be

adversely affected if coffee prices were to rise substantially.

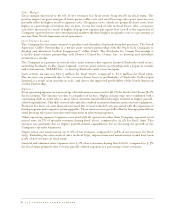

The Company enters into fixed-price purchase commitments in order to secure an adequate supply of

quality green coffee and bring greater certainty to the cost of sales in future periods. As of October 1,

2000, the Company had approximately $84 million in fixed-price purchase commitments which,

together with existing inventory, is expected to provide an adequate supply of green coffee for the majority

of fiscal 2001. The Company believes, based on relationships established with its suppliers in the past,

that the risk of non-delivery on such purchase commitments is remote.

starbucks coffee company P. 27