Starbucks 2000 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2000 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

employee stock purchase plan

The Company has an employee stock purchase plan which provides that eligible employees may

contribute up to 10% of their base earnings, up to $25,000 annually, toward the quarterly purchase of

the Company’s common stock. The employees’ purchase price is 85% of the lesser of the fair market

value of the stock on the first business day or the last business day of the quarterly offering period. No

compensation expense is recorded in connection with the plan. The total number of shares issuable

under the plan is 8,000,000. There were 403,771 shares issued under the plan during fiscal 2000 at

prices ranging from $20.37 to $32.73. There were 492,231 shares issued under the plan during fiscal

1999 at prices ranging from $14.05 to $25.18. There were 271,778 shares issued under the plan during

fiscal 1998 at prices ranging from $15.99 to $19.58. Of the 24,465 employees eligible to participate,

6,708 were participants in the plan as of October 1, 2000.

deferred stock plan

The Company has a Deferred Stock Plan for certain key employees that enables participants in the plan

to defer receipt of ownership of common shares from the exercise of non-qualified stock options. The

minimum deferral period is five years. As of October 1, 2000, receipt of 848,550 shares was deferred

under the terms of this plan. The rights to receive these shares, represented by common stock units, are

included in the calculation of basic and diluted earnings per share as common stock equivalents.

accounting for stock-based compensation

The Company accounts for its stock-based awards using the intrinsic value method in accordance with

Accounting Principles Board Opinion No. 25, “Accounting for Stock Issued to Employees” and its

related interpretations. Accordingly, no compensation expense has been recognized in the financial

statements for employee stock arrangements.

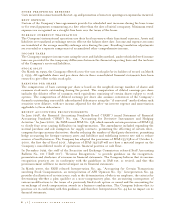

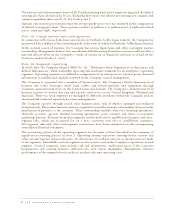

SFAS No. 123, “Accounting for Stock-Based Compensation,” requires the disclosure of pro forma net

income and net income per share as if the Company adopted the fair-value method of accounting for

stock-based awards as of the beginning of fiscal 1996. The fair value of stock-based awards to employees is

calculated using the Black-Scholes option-pricing model with the following weighted average assumptions:

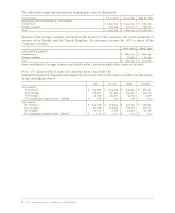

EMPLOYEE STOCK OPTIONS EMPLOYEE STOCK PURCHASE PLAN

2000 1999 1998 2000 1999 1998

Expected life (years) 2 - 6 1.5 - 6 1.5 - 6 0.25 0.25 0.25

Expected volatility 55% 50% 45% 42 - 82% 44 - 66% 37 - 45%

Risk-free interest rate 5.65 - 6.87% 4.60 - 6.21% 5.28 - 6.05% 5.97 - 6.40% 4.26 - 5.63% 5.26 - 5.74%

Expected dividend yield 0.00% 0.00% 0.00% 0.00% 0.00% 0.00%

The Company’s valuations are based upon a multiple option valuation approach and forfeitures are

recognized as they occur. The Black-Scholes option valuation model was developed for use in estimating the

fair value of traded options, which have no vesting restrictions and are fully transferable. In addition, option

valuation models require the input of highly subjective assumptions, including the expected stock-price

volatility. The Company’s employee stock options have characteristics significantly different from those of

traded options, and changes in the subjective input assumptions can materially affect the fair value estimate.

starbucks coffee company P. 43