Starbucks 2000 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2000 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

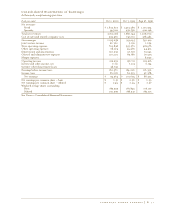

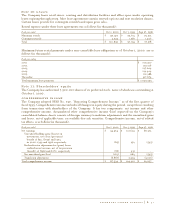

Note 10: Leases

The Company leases retail stores, roasting and distribution facilities and office space under operating

leases expiring through 2023. Most lease agreements contain renewal options and rent escalation clauses.

Certain leases provide for contingent rentals based upon gross sales.

Rental expense under these lease agreements was as follows (in thousands):

Fiscal year ended Oct 1, 2000 Oct 3, 1999 Sept 27, 1998

Minimum rentals $ 127,149 $ 95,613 $ 75,912

Contingent rentals 3,743 1,581 1,406

Total $ 130,892 $ 97,194 $ 77,318

Minimum future rental payments under non-cancelable lease obligations as of October 1, 2000, are as

follows (in thousands):

Fiscal year ending

2001 $ 129,407

2002 129,018

2003 127,604

2004 122,404

2005 112,988

Thereafter 417,874

Total minimum lease payments $ 1,039,295

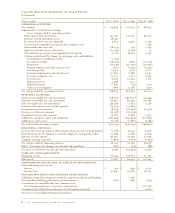

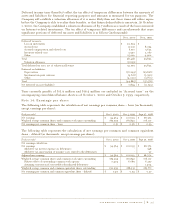

Note 11: Shareholders’ equity

The Company has authorized 7,500,000 shares of its preferred stock, none of which was outstanding at

October 1, 2000.

comprehensive income

The Company adopted SFAS No. 130, “Reporting Comprehensive Income,” as of the first quarter of

fiscal 1999. Comprehensive income includes all changes in equity during the period, except those resulting

from transactions with shareholders of the Company. It has two components: net income and other

comprehensive income. Accumulated other comprehensive income (loss) reported on the Company’s

consolidated balance sheets consists of foreign currency translation adjustments and the unrealized gains

and losses, net of applicable taxes, on available-for-sale securities. Comprehensive income, net of related

tax effects, is as follows (in thousands):

Fiscal year ended Oct 1, 2000 Oct 3, 1999 Sept 27, 1998

Net earnings $ 94,564 $ 101,693 $ 68,372

Unrealized holding gains (losses) on

investments, net of tax (provision)

benefit of $52, ($155) and $373

in 2000, 1999 and 1998, respectively (85) 252 (595)

Reclassification adjustment for (gains) losses

realized in net income, net of tax provision

(benefit) of ($48) and $270, respectively (78) 431 -

Net unrealized gain (loss) (163) 683 (595)

Translation adjustment (6,867) 2,534 (5,120)

Total comprehensive income $ 87,534 $ 104,910 $ 62,657

starbucks coffee company P. 41