Starbucks 2000 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2000 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

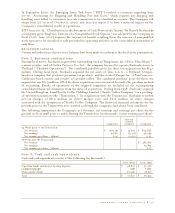

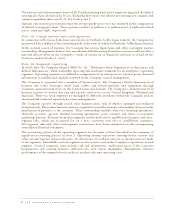

As required by SFAS No. 123, the Company has determined that the weighted average estimated fair

values of options granted during fiscal 2000, 1999 and 1998 were $10.74, $8.86 and $7.20 per share,

respectively. Had compensation costs for the Company’s stock-based compensation plans been accounted

for using the fair value method of accounting described by SFAS No. 123, the Company’s net earnings and

earnings per share would have been as follows (in thousands, except earnings per share):

PRO FORMA

UNDER SFAS

Fiscal year ended AS REPORTED NO. 123

October 1, 2000:

Net earnings $ 94,564 $ 66,241

Net earnings per common share:

Basic $ 0.51 $ 0.36

Diluted $ 0.49 $ 0.35

October 3, 1999:

Net earnings $ 101,693 $ 75,326

Net earnings per common share:

Basic $ 0.56 $ 0.41

Diluted $ 0.54 $ 0.40

September 27, 1998:

Net earnings $ 68,372 $ 51,595

Net earnings per common share:

Basic $ 0.39 $ 0.30

Diluted $ 0.37 $ 0.28

In applying SFAS No. 123, the impact of outstanding stock options granted prior to 1996 has been excluded

from the pro forma calculations; accordingly, the 2000, 1999 and 1998 pro forma adjustments are not

necessarily indicative of future period pro forma adjustments.

defined contribution plans

Starbucks maintains voluntary defined contribution plans covering eligible employees as defined in

the plan documents. Participating employees may elect to defer and contribute a percentage of their

compensation to the plan, not to exceed the dollar amount set by law. For certain plans, the Company

matches 25% of each employee’s eligible contribution up to a maximum of the first 4% of each

employee’s compensation.

The Company’s matching contributions to the plans were approximately $1.1 million, $0.9 million and

$0.8 million for fiscal 2000, 1999 and 1998, respectively.

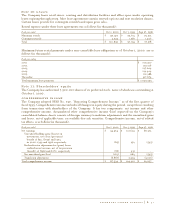

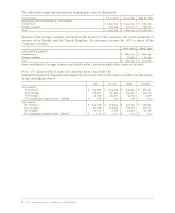

Note 13: Income taxes

A reconciliation of the statutory federal income tax rate with the Company’s effective income tax rate is

as follows:

Fiscal year ended Oct 1, 2000 Oct 3, 1999 Sept 27, 1998

Statutory rate 35.0% 35.0% 35.0%

State income taxes, net of federal

income tax benefit 3.7 3.7 3.8

Non-deductible losses and merger costs - - 2.6

Valuation allowance change from prior year 3.5 - -

Other, net (1.1) (0.7) (0.2)

Effective tax rate 41.1% 38.0% 41.2%

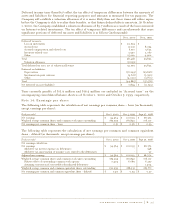

The provision for income taxes consists of the following (in thousands):

Fiscal year ended Oct 1, 2000 Oct 3, 1999 Sept 27, 1998

Currently payable:

Federal $ 71,758 $ 52,207 $ 39,267

State 12,500 9,332 6,586

Deferred (asset) liability, net (18,252) 794 2,125

Total $ 66,006 $ 62,333 $ 47,978

P. 44 starbucks coffee company