Starbucks 2000 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2000 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

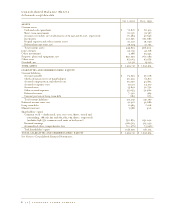

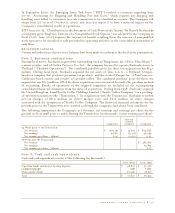

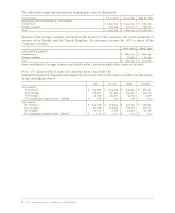

Note 5: Inventories

Inventories consist of the following (in thousands):

Oct 1, 2000 Oct 3, 1999

Coffee:

Unroasted $ 90,807 $ 95,001

Roasted 27,880 28,065

Other merchandise held for sale 59,420 37,564

Packaging and other supplies 23,549 20,256

Total $ 201,656 $ 180,886

As of October 1, 2000, the Company had fixed-price inventory purchase commitments for green

coffee totaling approximately $84 million. The Company believes, based on relationships established

with its suppliers in the past, that the risk of non-delivery on such purchase commitments is remote.

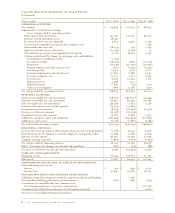

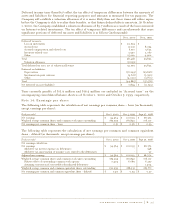

Note 6: Joint ventures

The Company has two joint ventures to produce and distribute Starbucks branded products. The North

American Coffee Partnership is a 50/50 joint venture partnership with the Pepsi-Cola Company to

develop and distribute bottled Frappuccino®coffee drink. The Starbucks Ice Cream Partnership is a

50/50 joint venture partnership with Dreyer’s Grand Ice Cream, Inc. to develop and distribute premium

ice creams.

The Company is a partner in several other joint ventures that operate licensed Starbucks retail stores,

including Starbucks Coffee Japan Limited, a 50/50 joint venture partnership with a Japanese retailer

and restauranteur, SAZABY Inc., to develop Starbucks retail stores in Japan. The Company also has

interests in joint ventures to develop Starbucks retail stores in Hawaii, Taiwan, Shanghai, Hong Kong

and Switzerland.

The Company accounts for these investments using the equity method when Starbucks is deemed to have

significant influence over the investee but is not the controlling or managing partner; otherwise, the

investment is accounted for using the cost method. The Company’s share of income and losses for equity

method joint ventures is included in “Joint venture income” on the accompanying consolidated statements

of earnings. This line includes both the Company’s proportionate share of gross margin resulting from the

sale of coffee and other products to the joint ventures and the Company’s proportionate share of royalty

and license fee revenues received from the joint ventures.

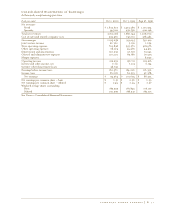

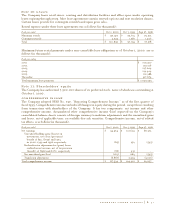

The Company’s investments in these joint ventures are as follows (in thousands):

EQUITY COST

JOINT JOINT

VENTURES VENTURES TOTAL

Balance, September 28, 1997 $ 29,263 $ - $ 29,263

Allocated share of losses (14) - (14)

Distributions from joint ventures (2,750) - (2,750)

Capital contributions 12,059 359 12,418

Balance, September 27, 1998 38,558 359 38,917

Allocated share of income 2,318 - 2,318

Distributions from joint ventures (8,983) - (8,983)

Capital contributions 10,466 - 10,466

Balance, October 3, 1999 42,359 359 42,718

Allocated share of income 15,139 - 15,139

Distributions from joint ventures (14,279) - (14,279)

Capital contributions 8,049 424 8,473

Balance, October 1, 2000 $ 51,268 $ 783 $ 52,051

The Company has a consolidated 90/10 joint venture with Starbucks Coffee Company (Australia) Pty

Ltd. to develop retail stores in Australia. In addition, the Company has a consolidated 50/50 joint

venture, Urban Coffee Opportunities, LLC, with Johnson Development Corporation to develop retail

stores in under-served urban communities.

starbucks coffee company P. 39