Starbucks 2000 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2000 Starbucks annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

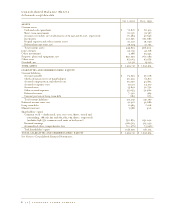

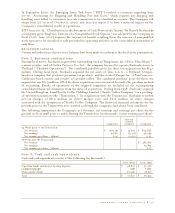

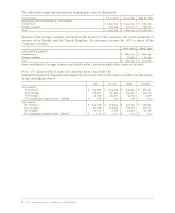

Note 4: Short-term investments

The Company’s investments consist of the following (in thousands):

GROSS GROSS

UNREALIZED UNREALIZED

FAIR AMORTIZED HOLDING HOLDING

October 1, 2000: VALUE COST GAINS LOSSES

Short-term investments - available-for-sale:

U.S. Government obligations $ 10,990 $ 10,996 $ 3 $ (9)

Commercial paper 45,356 45,373 1 (18)

Marketable equity securities 1,227 1,227 - -

Total $ 57,573 $ 57,596 $ 4 $ (27)

Short-term investments - trading 3,763

Total short-term investments $ 61,336

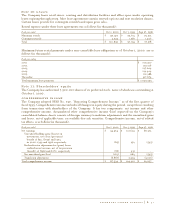

GROSS GROSS

UNREALIZED UNREALIZED

FAIR AMORTIZED HOLDING HOLDING

October 3, 1999: VALUE COST GAINS LOSSES

Short-term investments - available-for-sale:

Corporate debt securities $ 17,233 $ 17,123 $ 155 $ (45)

U.S. Government obligations 4,988 4,976 13 (1)

Commercial paper 18,706 18,751 - (45)

Mutual funds 2,056 2,002 73 (19)

Marketable equity securities 8,384 8,258 313 (187)

Total $ 51,367 $ 51,110 $ 554 $ (297)

Long-term investments:

U.S. Government obligations $ 5,028 $ 5,044 $ - $ (16)

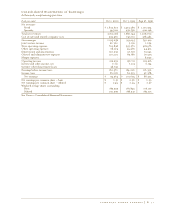

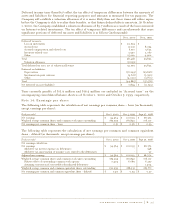

Available-for-sale securities with remaining maturities of one year or less are classified as short-term

investments. Securities with remaining maturities longer than one year are classified as long-term and

are included in the line item “Other investments” on the accompanying consolidated balance sheets.

The specific identification method is used to determine a cost basis for computing realized gains

and losses.

In fiscal 2000, 1999 and 1998, proceeds from the sale of investment securities were $49.2 million, $3.6

million and $5.1 million, respectively. Gross realized gains and losses from the sale of securities were not

material in 2000, 1999 and 1998.

During fiscal 2000, the Company recorded a loss of $6.8 million on its investment in the common

stock of Talk City, Inc., due to an impairment that was determined by management to be other than

temporary. The remaining fair value of the investment was $1.2 million as of October 1, 2000.

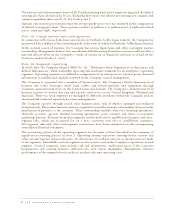

Trading securities are classified as short-term investments. The trading securities are marketable equity

funds designated to approximate the Company’s liability under the Management Deferred

Compensation Plan (“MDCP”). The corresponding deferred compensation liability of $3.8 million is

included in “Accrued compensation and related costs” on the accompanying consolidated balance

sheets. The change in net unrealized holding gains in the trading portfolio included in earnings during

the year was $0.3 million. There were no trading securities as of October 3, 1999.

P. 38 starbucks coffee company