Singapore Airlines 2013 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2013 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

046

SINGAPORE AIRLINES

CORPORATE GOVERNANCE REPORT

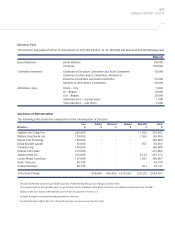

Share Incentive Plans

i. The SIA Performance Share Plan (“PSP”)

The PSP is a share-based incentive scheme established with the objective of rewarding, motivating and retaining a select

group of key Senior Management staff who shoulder the responsibility for the Group’s performance and who are able

to drive the growth of the Group through innovation, creativity and superior performance. Awards under the PSP are

performance-based, with stretched targets.

Under the PSP, an initial award is made in the form of rights to shares, provided performance targets are met. Annual

awards are made based on strategic contribution of Senior Management staff. The final award, which can vary between

0-200 per cent of the initial award, depends on stretched value-aligned performance targets. They are based on absolute

and relative Total Shareholder Return (“TSR”), meeting targets over the performance period of three financial years.

The relative TSR is based on outperformance of a selected peer group of leading full service carriers. The absolute

TSR is based on outperformance against Cost of Equity hurdle. The above performance measures are selected as key

measurements of wealth creation for shareholders.

ii. The SIA Restricted Share Plan (“RSP”)

The RSP is targeted at a broader base of senior executives and enhances the Company’s ability to recruit and retain

talented senior executives, as well as to reward for Group, Company and individual performance. To retain key executives,

an extended vesting period of a further two years is imposed beyond the initial two-year performance period.

Under the RSP, an initial award is made in the form of rights to shares, provided performance conditions are met in

future. Annual grants are made based on individual performance of the key executives selected to participate in the RSP.

Final awards may vary between 0-150 per cent of the initial award, depending on the extent to which targets based on

Group and Company EBITDAR Margin and Group and Company Staff Productivity are met. The performance measures

are selected as they are key drivers of shareholder value and are aligned to the Group and the Company’s business

objectives. The Final award is subject to extended vesting, with 50 per cent of the Final award paid out at the end of the

two-year performance period, and the rest paid out equally over the next two years.

The total number of ordinary shares which may be issued pursuant to awards granted under the RSP and PSP, when

added to the number of new shares issued and issuable in respect of all awards under the RSP and PSP, and all options

under the Employee Share Option Plan (“ESOP”), shall not exceed 13 per cent of the issued ordinary share capital of

the Company. In addition, the maximum number of new shares that can be issued pursuant to awards granted under

the RSP and PSP in the period between the current Annual General Meeting (“AGM”) to the next AGM shall not exceed

0.75 per cent of the total number of issued ordinary shares in the capital of the Company.

Details of the PSP, RSP and ESOP can be found on pages 83 to 86 of the Report by the Board of Directors.

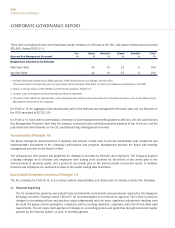

Pay-for-Performance Alignment

In performing the duties as required under its BCIRC Charter, the BCIRC ensures that remuneration paid to the CEO

and Key Management Personnel is strongly linked to the achievement of business and individual performance targets.

The performance targets as determined by the BCIRC are set at realistic yet stretched levels each year to motivate a high

degree of business performance with emphasis on both short- and long-term quantifiable objectives.