Singapore Airlines 2013 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2013 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210

|

|

143

ANNUAL REPORT 2012/13

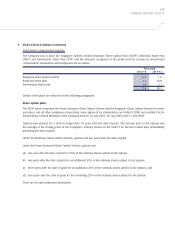

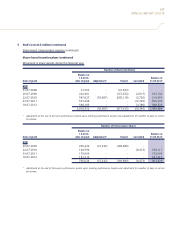

12 Earnings Per Share (continued)

Basic earnings per share is calculated by dividing the profit attributable to owners of the Parent by the weighted average

number of ordinary shares in issue during the financial year.

For purposes of calculating diluted earnings per share, the profit attributable to owners of the Parent is adjusted to take into

account effects of dilutive potential ordinary shares of subsidiary companies and the weighted average number of ordinary

shares of the Company in issue is adjusted to take into account effects of dilutive options of the Company.

20.5 million (2011-12: 21.1 million) of the share options granted to employees under the existing employee share option

plans have not been included in the calculation of diluted earnings per share because they are anti-dilutive for the current

and previous years presented.

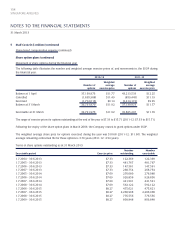

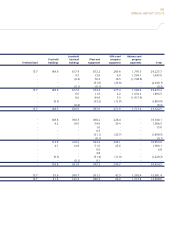

13 Dividends Paid and Proposed (in $ million)

The Group and

the Company

2012-13 2011-12

Dividends paid:

Final dividend of 10.0 cents per share tax exempt (one-tier) in respect of 2011-12 117.5 479.7

(2011-12: 40.0 cents per share tax exempt [one-tier] in respect of 2010-11)

Special dividend of 80.0 cents per share tax exempt (one-tier) in respect of 2010-11 - 959.3

Interim dividend of 6.0 cents per share tax exempt (one-tier) in respect of 2012-13 70.5 118.2

(2011-12: 10.0 cents per share tax exempt [one-tier] in respect of 2011-12)

188.0 1,557.2

The directors propose that a final tax exempt (one-tier) dividend of 17.0 cents per share (2011-12: final tax exempt [one-

tier] dividend of 10.0 cents per share) amounting to $199.8 million (2011-12: $117.5 million) be paid for the financial year

ended 31 March 2013.

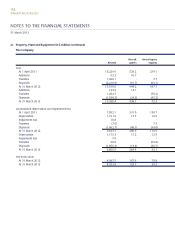

14 Share Capital (in $ million)

The Group and the Company

Number of shares Amount

2013 2012 2013 2012

Issued and fully paid share capital

Ordinary shares

Balance at 1 April 1,199,851,018 1,197,928,580 1,856.1 1,832.4

Share options exercised and share awards

vested during the year - 1,922,438 - 23.7

Balance at 31 March 1,199,851,018 1,199,851,018 1,856.1 1,856.1

Special share

Balance at 1 April and 31 March 1 1 # #

# The value is $0.50