Singapore Airlines 2013 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2013 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210

|

|

176

SINGAPORE AIRLINES

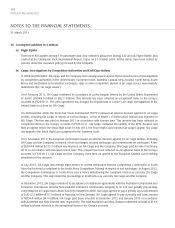

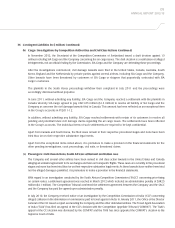

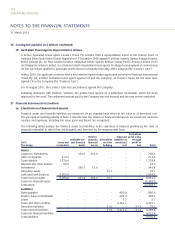

NOTES TO THE FINANCIAL STATEMENTS

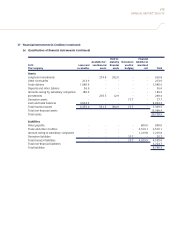

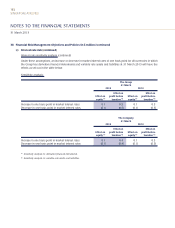

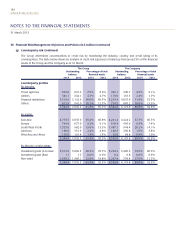

37 Financial Instruments (in $ million) (continued)

(b) Fair values

Financial instruments carried at fair value

Fair value hierarchy

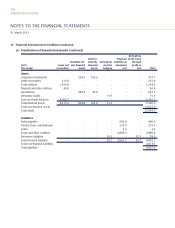

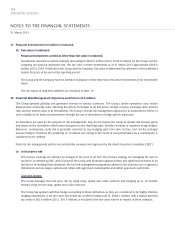

The following table shows an analysis of financial instruments carried at fair value by level of fair value hierarchy:

The Group

31 March 2013 31 March 2012

Quoted Quoted

prices in prices in

active Significant active Significant

markets for other markets for other

identical observable identical observable

instruments inputs instruments inputs

(Level 1) (Level 2) (Level 1) (Level 2)

Financial assets:

Available-for-sale investments

Quoted investments

- Government securities 3.0 - 4.1 -

- Equity investments 166.5 - 32.8 -

- Non-equity investments 279.5 - 232.0 -

Unquoted investments

- Government securities - - - 307.5

- Non-equity investments - 143.5 - 159.6

Derivative assets

Currency hedging contracts - 24.2 - 21.3

Fuel hedging contracts - 52.7 - 46.7

Interest rate cap contracts - 2.2 - 3.9

449.0 222.6 268.9 539.0

Financial liabilities:

Derivative liabilities

Currency hedging contracts - 19.2 - 15.5

Fuel hedging contracts - 6.5 - 0.6

Cross currency swap contracts - 40.7 - 50.9

Interest rate swap contracts - 6.8 - 11.9

- 73.2 - 78.9

The Group classifies fair value measurement using a fair value hierarchy that reflects the significance of the inputs used

in making the measurements. The fair value hierarchy has the following levels:

• Level 1 – Quoted prices (unadjusted) in active markets for identical assets or liabilities

• Level 2 – Inputs other than quoted prices included within Level 1 that are observable for the asset or liability,

either directly (i.e., as prices) or indirectly (i.e., derived from prices)

31 March 2013