Salesforce.com 2016 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2016 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

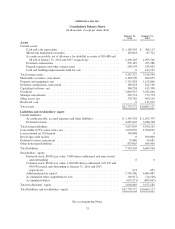

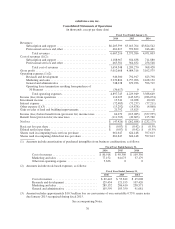

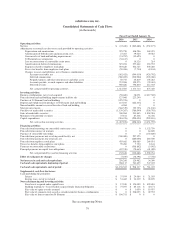

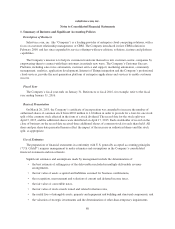

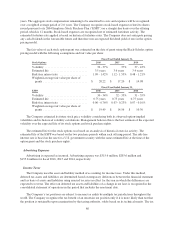

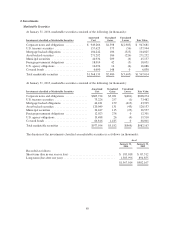

salesforce.com, inc.

Consolidated Statements of Cash Flows

(in thousands)

Fiscal Year Ended January 31,

2016 2015 2014

Operating activities:

Net loss ....................................................................... $ (47,426) $ (262,688) $ (232,175)

Adjustments to reconcile net loss to net cash provided by operating activities:

Depreciation and amortization ................................................. 525,750 448,296 369,423

Amortization of debt discount and transaction costs ................................. 27,467 39,620 49,582

Gain on sales of land and building improvements .................................. (21,792) (15,625) 0

50 Fremont lease termination .................................................. (36,617) 0 0

Loss on conversions of convertible senior notes .................................... 0 10,326 214

Amortization of deferred commissions ........................................... 319,074 257,642 194,553

Expenses related to employee stock plans ........................................ 593,628 564,765 503,280

Excess tax benefits from employee stock plans .................................... (59,496) (7,730) (8,144)

Changes in assets and liabilities, net of business combinations:

Accounts receivable, net .................................................. (582,425) (544,610) (424,702)

Deferred commissions .................................................... (380,022) (320,904) (265,080)

Prepaid expenses and other current assets and other assets ....................... 50,772 45,819 105,218

Accounts payable, accrued expenses and other liabilities ......................... 253,986 159,973 (29,043)

Deferred revenue ........................................................ 969,686 798,830 612,343

Net cash provided by operating activities ..................................... 1,612,585 1,173,714 875,469

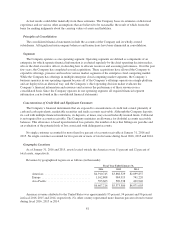

Investing activities:

Business combinations, net of cash acquired .......................................... (58,680) 38,071 (2,617,302)

Proceeds from land and building improvements held for sale ............................. 127,066 223,240 0

Purchase of 50 Fremont land and building ............................................ (425,376) 0 0

Deposit and withdrawal for purchase of 50 Fremont land and building ...................... 115,015 (126,435) 0

Non-refundable amounts received for sale of land and building ........................... 6,284 0 0

Strategic investments ............................................................. (366,519) (93,725) (31,160)

Purchases of marketable securities .................................................. (1,139,267) (780,540) (558,703)

Sales of marketable securities ...................................................... 500,264 243,845 1,038,284

Maturities of marketable securities .................................................. 37,811 87,638 36,436

Capital expenditures ............................................................. (284,476) (290,454) (299,110)

Net cash used in investing activities ......................................... (1,487,878) (698,360) (2,431,555)

Financing activities:

Proceeds from borrowings on convertible senior notes, net ............................... 0 0 1,132,750

Proceeds from issuance of warrants ................................................. 0 0 84,800

Purchase of convertible note hedge .................................................. 0 0 (153,800)

Proceeds from (payments on) revolving credit facility, net ............................... (300,000) 297,325 0

Proceeds from (payments on) term loan, net ........................................... 0 (285,000) 283,500

Proceeds from employee stock plans ................................................ 455,482 308,989 289,931

Excess tax benefits from employee stock plans ........................................ 59,496 7,730 8,144

Payments on convertible senior notes ................................................ 0 (568,862) (5,992)

Principal payments on capital lease obligations ........................................ (82,330) (70,663) (41,099)

Net cash provided by (used in) financing activities ............................. 132,648 (310,481) 1,598,234

Effect of exchange rate changes ................................................... (7,109) (38,391) (7,758)

Net increase in cash and cash equivalents ........................................... 250,246 126,482 34,390

Cash and cash equivalents, beginning of period ...................................... 908,117 781,635 747,245

Cash and cash equivalents, end of period ........................................... $1,158,363 $ 908,117 $ 781,635

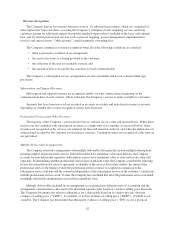

Supplemental cash flow disclosure:

Cash paid during the period for:

Interest .................................................................... $ 37,954 $ 24,684 $ 21,503

Income taxes, net of tax refunds ................................................ $ 31,462 $ 36,219 $ 28,870

Non-cash financing and investing activities:

Fixed assets acquired under capital leases ........................................ $ 12,948 $ 124,099 $ 492,810

Building in progress—leased facility acquired under financing obligation ............... $ 77,057 $ 85,118 $ 40,171

Fair value of equity awards assumed ............................................ $ 0 $ 1,050 $ 19,037

Fair value of common stock issued as consideration for business combinations ........... $ 0 $ 338,033 $ 69,533

Fair value of loan assumed on 50 Fremont ........................................ $ 198,751 $ 0 $ 0

See accompanying Notes.

79