Salesforce.com 2016 Annual Report Download - page 72

Download and view the complete annual report

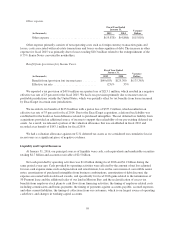

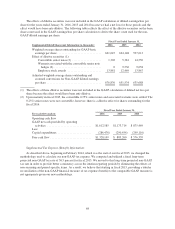

Please find page 72 of the 2016 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.•Income Tax Effects and Adjustments. Since fiscal 2015, the Company has utilized a fixed long-term

projected non-GAAP tax rate in order to provide better consistency across the interim reporting periods

by eliminating the effects of non-recurring and period-specific items such as changes in the tax

valuation allowance and tax effects of acquisitions-related costs, since each of these can vary in size

and frequency. When projecting this long-term rate, the Company evaluated a three-year financial

projection that excludes the direct impact of the following non-cash items: stock-based expenses,

amortization of purchased intangibles, amortization of acquired leases, amortization of debt discount,

gains/losses on the sales of land and building improvements, gains/losses on conversions of debt, and

termination of office leases. The projected rate also assumes no new acquisitions in the three-year

period, and considers other factors including the Company’s tax structure, its tax positions in various

jurisdictions and key legislation in major jurisdictions where the company operates. This long-term rate

could be subject to change for a variety of reasons, such as significant changes in the geographic

earnings mix including acquisition activity, or fundamental tax law changes in major jurisdictions

where the company operates. The Company re-evaluates this long-term rate on an annual basis and, as

appropriate, if a significant event materially affects it. Our fiscal 2016 non-GAAP tax provision was

35.5 percent which reflected the related tax impact from the recent Tax Court decision in Altera

Corporation’s litigation with the Internal Revenue Service (“IRS”).

Additionally, as significant, unusual or discrete events occur, or as other events occur that are not related to

the Company’s core, ongoing operating results, we may exclude the financial results of these events from non-

GAAP net income in the period in which such events occur. For example, we could in the future recognize a

significant gain or loss in connection with one or more of our strategic investments, which may not be viewed by

management as reflective of our core, ongoing operating results. Similarly, the financial effects of significant

facilities-related transactions may in the future be excluded from non-GAAP net income in the period in which

such events may occur, if they are not viewed by management as reflective of our core, ongoing operating

results.

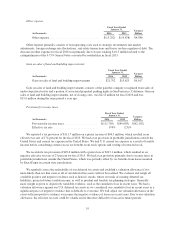

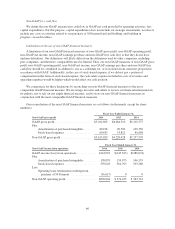

Non-GAAP gross profit

We define non-GAAP gross profit as our total revenues less cost of revenues, as reported on our

consolidated statement of operations, excluding the portions of stock-based expenses and amortization of

purchased intangibles that are included in cost of revenues.

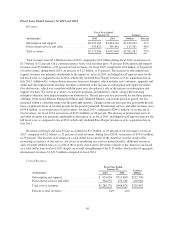

Non-GAAP operating profit

We define non-GAAP operating profit as our non-GAAP gross profit less operating expenses, as reported

on our consolidated statement of operations, excluding the portions of stock-based expenses, amortization of

purchased intangibles and gain resulting from termination of our office lease that are included in operating

expenses.

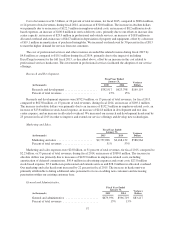

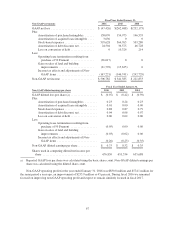

Non-GAAP earnings per share

Management uses the non-GAAP earnings per share to provide an additional view of performance by

excluding items that are not directly related to performance in any particular period in the earnings per share

calculation.

We define non-GAAP earnings per share as our non-GAAP net income divided by basic or diluted shares

outstanding.

65