Salesforce.com 2016 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2016 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

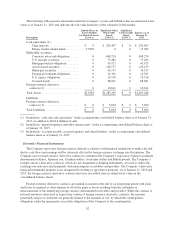

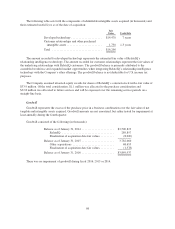

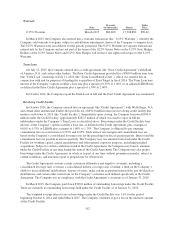

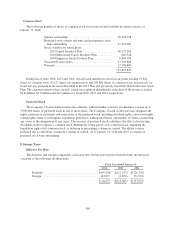

The following table sets forth the components of identifiable intangible assets acquired (in thousands) and

their estimated useful lives as of the date of acquisition:

Fair

Value Useful Life

Developed technology ..................... $14,470 7 years

Customer relationships and other purchased

intangible assets ........................ 1,730 1-3 years

Total .................................. $16,200

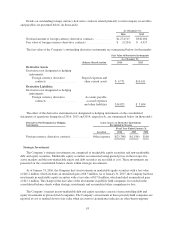

The amount recorded for developed technology represents the estimated fair value of RelateIQ’s

relationship intelligence technology. The amount recorded for customer relationships represent the fair values of

the underlying relationships with RelateIQ customers. The goodwill balance is primarily attributed to the

assembled workforce and expanded market opportunities when integrating RelateIQ’s relationship intelligence

technology with the Company’s other offerings. The goodwill balance is not deductible for U.S. income tax

purposes.

The Company assumed unvested equity awards for shares of RelateIQ’s common stock with a fair value of

$33.9 million. Of the total consideration, $1.1 million was allocated to the purchase consideration and

$32.8 million was allocated to future services and will be expensed over the remaining service periods on a

straight-line basis.

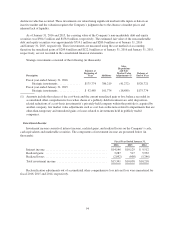

Goodwill

Goodwill represents the excess of the purchase price in a business combination over the fair value of net

tangible and intangible assets acquired. Goodwill amounts are not amortized, but rather tested for impairment at

least annually during the fourth quarter.

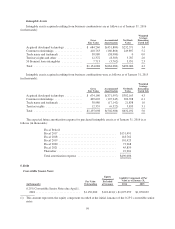

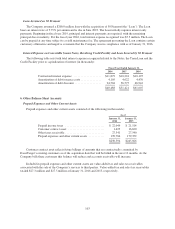

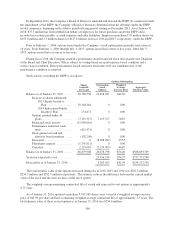

Goodwill consisted of the following (in thousands):

Balance as of January 31, 2014 ...................... $3,500,823

RelateIQ ................................... 289,857

Finalization of acquisition date fair values ......... (8,020)

Balance as of January 31, 2015 ...................... 3,782,660

Other acquisitions ............................ 68,655

Finalization of acquisition date fair values ......... (1,378)

Balance as of January 31, 2016 ...................... $3,849,937

There was no impairment of goodwill during fiscal 2016, 2015 or 2014.

98