Salesforce.com 2016 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2016 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

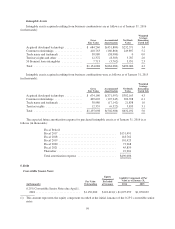

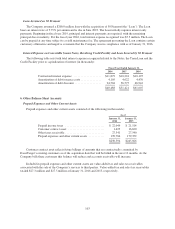

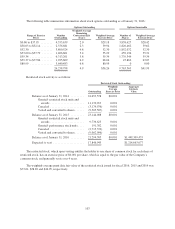

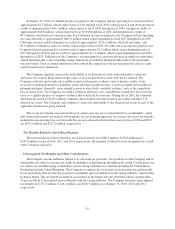

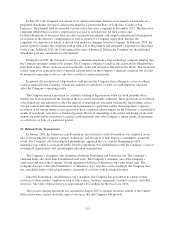

The provision for (benefit from) income taxes consisted of the following (in thousands):

Fiscal Year Ended January 31,

2016 2015 2014

Current:

Federal ................................. $ 40,723 $ 893 $ (10,431)

State ................................... 13,023 1,388 (245)

Foreign ................................. 57,347 50,493 39,784

Total ................................... 111,093 52,774 29,108

Deferred:

Federal ................................. 1,453 8,771 (128,798)

State ................................... (426) (10,830) (22,012)

Foreign ................................. (415) (1,112) (4,058)

Total ................................... 612 (3,171) (154,868)

Provision for (benefit from) income taxes ...... $111,705 $ 49,603 $(125,760)

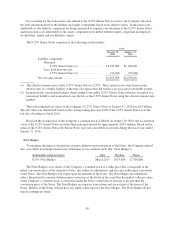

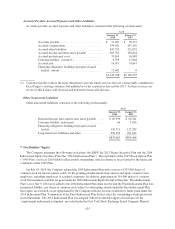

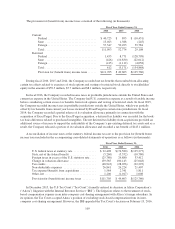

During fiscal 2016, 2015 and 2014, the Company recorded net tax benefits that resulted from allocating

certain tax effects related to exercises of stock options and vesting of restricted stock directly to stockholders’

equity in the amount of $59.5 million, $7.7 million and $8.1 million, respectively.

In fiscal 2016, the Company recorded income taxes in profitable jurisdictions outside the United States and

current tax expense in the United States. The Company had U.S. current tax expense as a result of taxable income

before considering certain excess tax benefits from stock options and vesting of restricted stock. In fiscal 2015,

the Company recorded income taxes in profitable jurisdictions outside the United States, which was partially

offset by tax benefits from current year losses incurred by ExactTarget in certain state jurisdictions. In fiscal

2014, the Company recorded a partial release of its valuation allowance primarily in connection with the

acquisition of ExactTarget. Due to the ExactTarget acquisition, a deferred tax liability was recorded for the book-

tax basis difference related to purchased intangibles. The net deferred tax liability from acquisitions provided an

additional source of income to support the realizability of the Company’s pre-existing deferred tax assets and as a

result, the Company released a portion of its valuation allowance and recorded a tax benefit of $143.1 million.

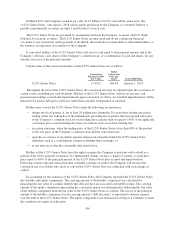

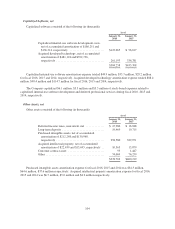

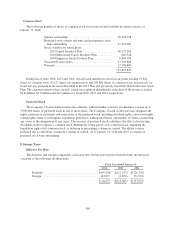

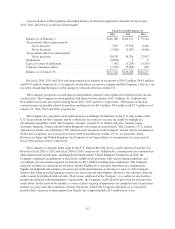

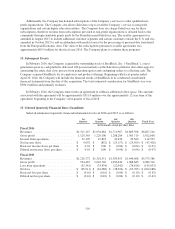

A reconciliation of income taxes at the statutory federal income tax rate to the provision for (benefit from)

income taxes included in the accompanying consolidated statements of operations is as follows (in thousands):

Fiscal Year Ended January 31,

2016 2015 2014

U.S. federal taxes at statutory rate ............... $ 22,498 $ (74,580) $(125,277)

State, net of the federal benefit .................. (5,260) (5,332) (10,780)

Foreign taxes in excess of the U.S. statutory rate .... (25,780) 29,880 33,412

Change in valuation allowance .................. 139,565 100,143 (25,048)

Tax credits .................................. (48,943) (28,056) (22,293)

Non-deductible expenses ...................... 26,841 26,224 21,407

Tax expense/(benefit) from acquisitions ........... 1,584 2,341 1,811

Other, net ................................... 1,200 (1,017) 1,008

Provision for (benefit from) income taxes ......... $111,705 $ 49,603 $(125,760)

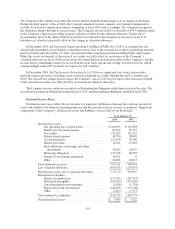

In December 2015, the U.S Tax Court (“Tax Court”) formally entered its decision in Altera Corporation’s

(“Altera”) litigation with the Internal Revenue Service (“IRS”). The litigation relates to the treatment of stock-

based compensation expense in an inter-company cost-sharing arrangement with Altera’s foreign subsidiary. In

its opinion, the Tax Court accepted Altera’s position of excluding stock-based compensation from its inter-

company cost-sharing arrangement. However, the IRS appealed the Tax Court’s decision on February 19, 2016.

109