Salesforce.com 2016 Annual Report Download - page 53

Download and view the complete annual report

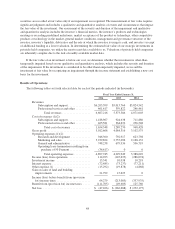

Please find page 53 of the 2016 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.received in advance of revenue recognition from subscription services described above and is recognized as the

revenue recognition criteria are met. We generally invoice customers in annual installments. The deferred

revenue balance is influenced by several factors, including seasonality, the compounding effects of renewals,

invoice duration, invoice timing, size and new business linearity within the quarter.

Deferred revenue that will be recognized during the succeeding twelve month period is recorded as current

deferred revenue and the remaining portion is recorded as noncurrent.

Deferred Commissions. We defer commission payments to our direct sales force. The commissions are

deferred and amortized to sales expense over the non-cancelable terms of the related subscription contracts with

our customers, which are typically 12 to 36 months. The commission payments, which are paid in full the month

after the customer’s service commences, are a direct and incremental cost of the revenue arrangements. The

deferred commission amounts are recoverable through the future revenue streams under the non-cancelable

customer contracts. We believe this is the preferable method of accounting as the commission charges are so

closely related to the revenue from the non-cancelable customer contracts that they should be recorded as an

asset and charged to expense over the same period that the subscription revenue is recognized.

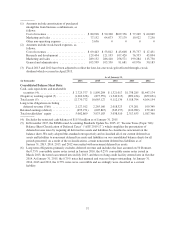

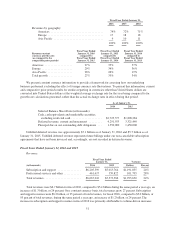

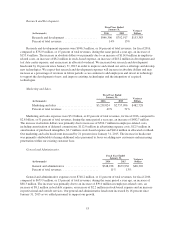

During fiscal 2016, we deferred $380.0 million of commission expenditures and we amortized $319.1 million

to sales expense. During the same period a year ago, we deferred $320.9 million of commission expenditures and

we amortized $257.6 million to sales expense. Deferred commissions on our consolidated balance sheets totaled

$449.1 million at January 31, 2016 and $388.2 million at January 31, 2015.

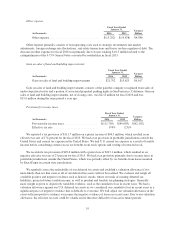

Capitalized Internal-Use Software Costs. We are required to follow the guidance of Accounting Standards

Codification 350 (“ASC 350”), Intangibles- Goodwill and Other in accounting for the cost of computer software

developed for internal-use and the accounting for web-based product development costs. ASC 350 requires

companies to capitalize qualifying computer software costs, which are incurred during the application

development stage, and amortize these costs on a straight-line basis over the estimated useful life of the

respective asset. We deliver our enterprise cloud computing solutions as a service via all the major Internet

browsers and on leading major mobile device operating systems. As a result of this software as a service delivery

model, we believe we have larger capitalized costs as compared to traditional enterprise software companies as

they are required to use a different accounting standard.

Costs related to preliminary project activities and post implementation activities are expensed as incurred.

Internal-use software is amortized on a straight-line basis over its estimated useful life. We evaluate the useful

lives of these assets on an annual basis and test for impairment whenever events or changes in circumstances

occur that could impact the recoverability of these assets.

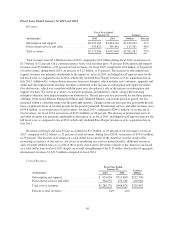

Business Combinations. Accounting for business combinations requires us to make significant estimates and

assumptions, especially at the acquisition date with respect to tangible and intangible assets acquired and

liabilities assumed and pre-acquisition contingencies. We use our best estimates and assumptions to accurately

assign fair value to the tangible and intangible assets acquired and liabilities assumed at the acquisition date.

Examples of critical estimates in valuing certain of the intangible assets and goodwill we have acquired

include but are not limited to:

• future expected cash flows from subscription and support contracts, professional services contracts,

other customer contracts and acquired developed technologies and patents;

• the acquired company’s trade name, trademark and existing customer relationship, as well as

assumptions about the period of time the acquired trade name and trademark will continue to be used in

our offerings;

• uncertain tax positions and tax related valuation allowances assumed; and

• discount rates.

46