Salesforce.com 2016 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2016 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

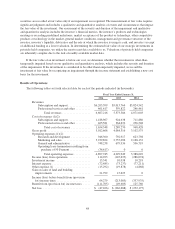

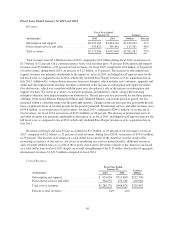

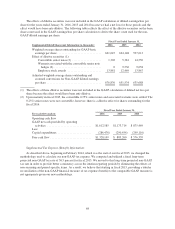

General and administrative expenses were $679.9 million, or 13 percent of total revenues, for fiscal 2015,

compared to $596.7 million, or 15 percent of total revenues, during fiscal 2014, a increase of $83.2 million. The

increase was primarily due to an increase of $53.1 million in employee-related costs, an increase of $18.9 million

in equipment costs and an increase of $11.7 million in stock-based expense, offset by a decrease of $3.0 million

in professional and outside services. Our general and administrative headcount increased by 9 percent in fiscal

2015 as we added personnel to support our growth.

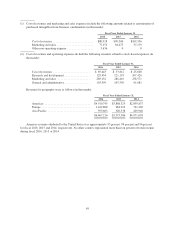

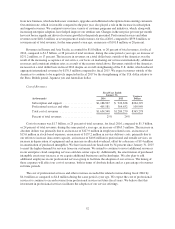

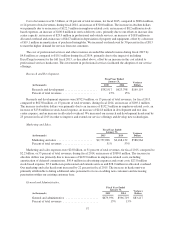

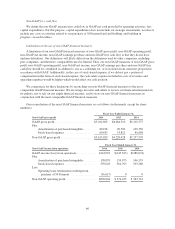

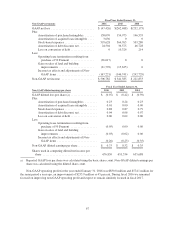

Loss from operations.

Fiscal Year Ended

January 31, Variance

Dollars(in thousands) 2015 2014

Loss from operations ......................... $(145,633) $(286,074) $140,441

Percent of total revenues ...................... (3)% (7)%

Loss from operations for fiscal 2015 was $145.6 million and included $564.8 million of stock-based

expenses and $155.0 million of amortization of purchased intangibles. During fiscal 2014, loss from operations

was $286.1 million and included $503.3 million of stock-based expenses and $146.5 million of amortization of

purchased intangibles.

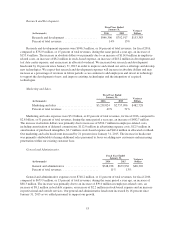

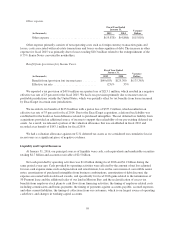

Investment income.

Fiscal Year Ended

January 31, Variance

Dollars(in thousands) 2015 2014

Investment income ............................... $10,038 $10,218 $(180)

Investment income consists of income on our cash and marketable securities balances. Investment income

was $10.0 million for fiscal 2015 and was $10.2 million during fiscal 2014.

Interest expense.

Fiscal Year Ended

January 31, Variance

Dollars(in thousands) 2015 2014

Interest expense ................................ $(73,237) $(77,211) $3,974

Percent of total revenues ......................... (1)% (2)%

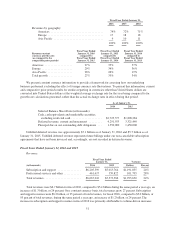

Interest expense consists of interest on our convertible senior notes, capital leases, term loan and revolving

credit facility. Interest expense, net of interest costs capitalized, was $73.2 million for fiscal 2015 and was $77.2

million during fiscal 2014. The decrease was primarily due to the reduced principal balance on our 0.75%

convertible senior notes as a result of early note conversions during fiscal 2015. These notes fully matured on

January 15, 2015.

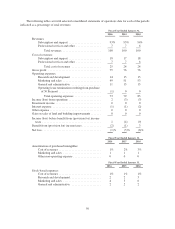

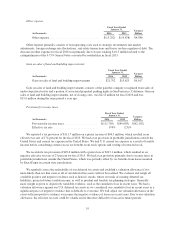

Gain on sales of land and building improvements.

During fiscal 2015, we sold two separate portions of our undeveloped real estate, including a portion of our

perpetual parking rights, in San Francisco, California. We recognized a gain of $15.6 million during fiscal 2015,

net of closing costs, as a result of this activity.

58