Salesforce.com 2016 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2016 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Unanticipated events and circumstances may occur that may affect the accuracy or validity of such

assumptions, estimates or actual results.

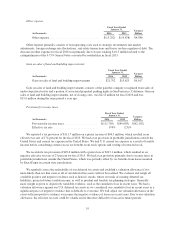

Goodwill and Intangibles. We make estimates, assumptions, and judgments when valuing goodwill and

other intangible assets in connection with the initial purchase price allocation of an acquired entity, as well as

when evaluating the recoverability of our goodwill and other intangible assets on an ongoing basis. These

estimates are based upon a number of factors, including historical experience, market conditions, and information

obtained from the management of acquired companies. Critical estimates in valuing certain intangible assets

include, but are not limited to, historical and projected attrition rates, discount rates, anticipated growth in

revenue from the acquired customers and acquired technology, and the expected use of the acquired assets. These

factors are also considered in determining the useful life of acquired intangible assets. The amounts and useful

lives assigned to identified intangible assets impacts the amount and timing of future amortization expense.

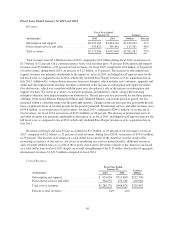

Income Taxes. We use the asset and liability method of accounting for income taxes. Under this method,

deferred tax assets and liabilities are determined based on temporary differences between the financial statement

and tax basis of assets and liabilities using enacted tax rates in effect for the year in which the differences are

expected to reverse. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the

consolidated statements of operations in the period that includes the enactment date. At each of the interim

financial reporting periods, we compute our tax provision by applying an estimated annual effective tax rate to

year to date ordinary income and adjust the provision for discrete tax items recorded in the same period. The

estimated annual effective tax rate at each interim period represents the best estimate based on evaluations of

possible future transactions and may be subject to subsequent refinement or revision.

Our tax positions are subject to income tax audits by multiple tax jurisdictions throughout the world. We

recognize the tax benefit of an uncertain tax position only if it is more likely than not that the position is

sustainable upon examination by the taxing authority, based on the technical merits. The tax benefit recognized is

measured as the largest amount of benefit which is greater than 50 percent likely to be realized upon settlement

with the taxing authority. We recognize interest accrued and penalties related to unrecognized tax benefits in our

income tax provision.

Valuation allowances are established when necessary to reduce deferred tax assets to the amounts that are

more likely than not expected to be realized based on the weighting of positive and negative evidence. Future

realization of deferred tax assets ultimately depends on the existence of sufficient taxable income of the

appropriate character (for example, ordinary income or capital gain) within the carryback or carryforward periods

available under the applicable tax law. We regularly review the deferred tax assets for recoverability based on

historical taxable income, projected future taxable income, the expected timing of the reversals of existing

temporary differences and tax planning strategies. Our judgment regarding future profitability may change due to

many factors, including future market conditions and the ability to successfully execute the business plans and/or

tax planning strategies. Should there be a change in the ability to recover deferred tax assets, our income tax

provision would increase or decrease in the period in which the assessment is changed.

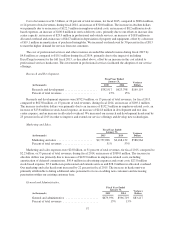

Strategic Investments. We hold strategic investments in marketable equity securities and non-marketable

debt and equity securities in which we do not have a controlling interest or significant influence, as defined in

Accounting Standards Codification 323 (“ASC 323”), Investments—Equity Method and Joint Ventures.

Marketable equity securities are measured using quoted prices in their respective active markets and non-

marketable debt and equity securities are recorded at cost and presented in the consolidated balance sheet. If,

based on the terms of our ownership of these marketable and non-marketable securities, we determine that we

exercise significant influence on the entity to which these marketable and non-marketable securities relate, we

apply the requirements of ASC 323 to account for such investments.

We determine the fair value of our marketable equity securities and non-marketable debt and equity

securities quarterly for impairment and disclosure purposes; however, the non-marketable debt and equity

47