Salesforce.com 2016 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2016 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In March 2013, the Company issued at par value $1.15 billion of 0.25% convertible senior notes (the

“0.25% Senior Notes”) due April 1, 2018, unless earlier purchased by the Company or converted. Interest is

payable semi-annually, in arrears on April 1 and October 1 of each year.

The 0.25% Senior Notes are governed by an indenture between the Company, as issuer, and U.S. Bank

National Association, as trustee. The 0.25% Senior Notes are unsecured and do not contain any financial

covenants or any restrictions on the payment of dividends, the incurrence of senior debt or other indebtedness, or

the issuance or repurchase of securities by the Company.

If converted, holders of the 0.25% Senior Notes will receive cash equal to the principal amount, and at the

Company’s election, cash, shares of the Company’s common stock, or a combination of cash and shares, for any

amounts in excess of the principal amounts.

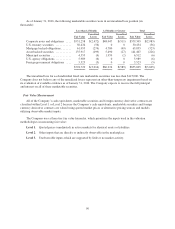

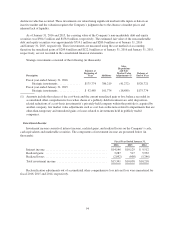

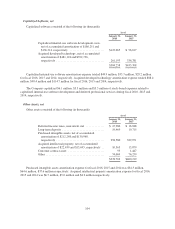

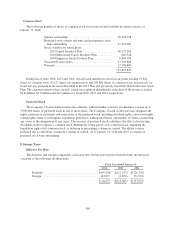

Certain terms of the conversion features of the 0.25% Senior Notes are as follows:

Conversion

Rate per $1,000

Par Value

Initial

Conversion

Price per

Share Convertible Date

0.25% Senior Notes .................. 15.0512 $66.44 January 1, 2018

Throughout the term of the 0.25% Senior Notes, the conversion rate may be adjusted upon the occurrence of

certain events, including any cash dividends. Holders of the 0.25% Senior Notes will not receive any cash

payment representing accrued and unpaid interest upon conversion of a Note. Accrued but unpaid interest will be

deemed to be paid in full upon conversion rather than canceled, extinguished or forfeited.

Holders may convert the 0.25% Senior Notes under the following circumstances:

• during any fiscal quarter, if, for at least 20 trading days during the 30 consecutive trading day period

ending on the last trading day of the immediately preceding fiscal quarter, the last reported sales price

of the Company’s common stock for such trading day is greater than or equal to 130% of the applicable

conversion price on such trading day share of common stock on such last trading day;

• in certain situations, when the trading price of the 0.25% Senior Notes is less than 98% of the product

of the sale price of the Company’s common stock and the conversion rate;

• upon the occurrence of specified corporate transactions described under the 0.25% Senior Notes

indenture, such as a consolidation, merger or binding share exchange; or

• at any time on or after the convertible date noted above.

Holders of the 0.25% Senior Notes have the right to require the Company to purchase with cash all or a

portion of the Notes upon the occurrence of a fundamental change, such as a change of control, at a purchase

price equal to 100% of the principal amount of the 0.25% Senior Notes plus accrued and unpaid interest.

Following certain corporate transactions that constitute a change of control, the Company will increase the

conversion rate for a holder who elects to convert the 0.25% Senior Notes in connection with such change of

control.

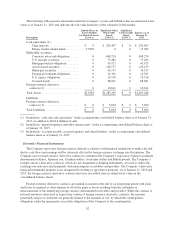

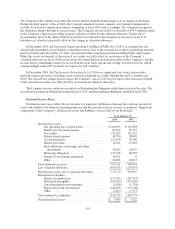

In accounting for the issuances of the 0.25% Senior Notes, the Company separated the 0.25% Senior Notes

into liability and equity components. The carrying amount of the liability component was calculated by

measuring the fair value of a similar liability that does not have an associated convertible feature. The carrying

amount of the equity component representing the conversion option was determined by deducting the fair value

of the liability component from the par value of the 0.25% Senior Notes as a whole. The excess of the principal

amount of the liability component over its carrying amount (“debt discount”) is amortized to interest expense

over the term of the 0.25% Senior Notes. The equity component is not remeasured as long as it continues to meet

the conditions for equity classification.

100