Salesforce.com 2016 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2016 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

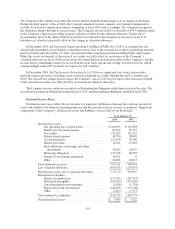

Loan Assumed on 50 Fremont

The Company assumed a $200.0 million loan with the acquisition of 50 Fremont (the “Loan”). The Loan

bears an interest rate of 3.75% per annum and is due in June 2023. The Loan initially requires interest only

payments. Beginning in fiscal year 2019, principal and interest payments are required, with the remaining

principal due at maturity. For the fiscal year 2016, total interest expense recognized was $7.3 million. The Loan

can be prepaid at any time subject to a yield maintenance fee. The agreement governing the Loan contains certain

customary affirmative and negative covenants that the Company was in compliance with as of January 31, 2016.

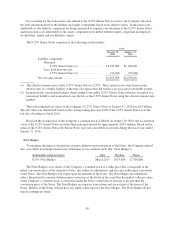

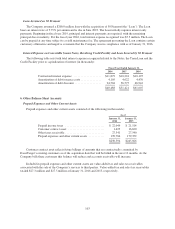

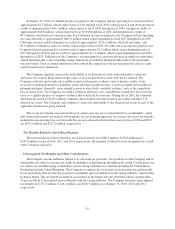

Interest Expense on Convertible Senior Notes, Revolving Credit Facility and Loan Secured by 50 Fremont

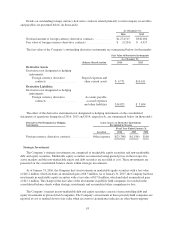

The following table sets forth total interest expense recognized related to the Notes, the Term Loan and the

Credit Facility prior to capitalization of interest (in thousands):

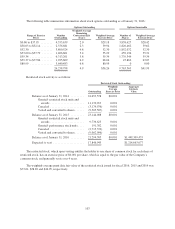

Fiscal Year Ended January 31,

2016 2015 2014

Contractual interest expense ................... $11,879 $10,224 $10,195

Amortization of debt issuance costs .............. 4,105 4,622 4,470

Amortization of debt discount .................. 24,504 36,575 46,942

$40,488 $51,421 $61,607

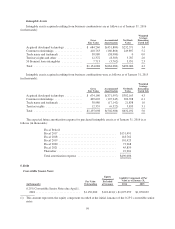

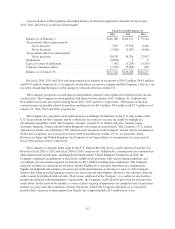

6. Other Balance Sheet Accounts

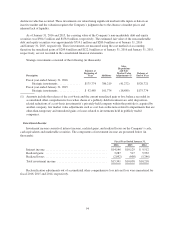

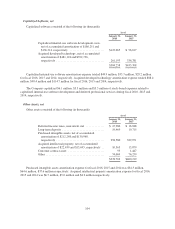

Prepaid Expenses and Other Current Assets

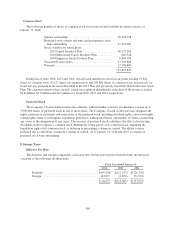

Prepaid expenses and other current assets consisted of the following (in thousands):

As of

January 31,

2016

January 31,

2015

Prepaid income taxes ........................... $ 22,044 $ 21,514

Customer contract asset ......................... 1,423 16,620

Other taxes receivable ........................... 27,341 27,540

Prepaid expenses and other current assets ........... 199,786 179,352

$250,594 $245,026

Customer contract asset reflects future billings of amounts that are contractually committed by

ExactTarget’s existing customers as of the acquisition date that will be billed in the next 12 months. As the

Company bills these customers this balance will reduce and accounts receivable will increase.

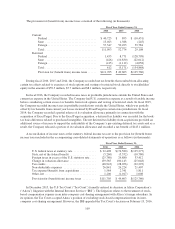

Included in prepaid expenses and other current assets are value-added tax and sales tax receivables

associated with the sale of the Company’s services to third parties. Value-added tax and sales tax receivables

totaled $27.3 million and $27.5 million at January 31, 2016 and 2015, respectively.

103