Salesforce.com 2016 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2016 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

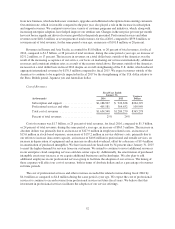

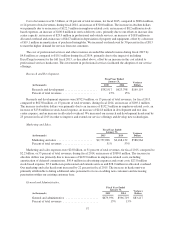

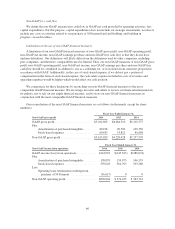

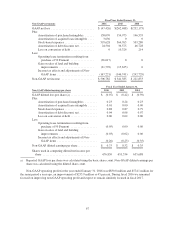

Our principal commitments consist of obligations under leases for office space, co-location data center

facilities, and our development and test data center, as well as leases for computer equipment, software, furniture

and fixtures. At January 31, 2016, the future non-cancelable minimum payments under these commitments were

as follows (in thousands):

Contractual Obligations

Payments Due by Period

Total

Less than

1 Year 1-3 Years 3-5 Years

More than

5 Years

Capital lease obligations, including interest .... $ 558,411 $118,820 $ 238,048 $201,543 $ 0

Operating lease obligations:

Facilities space ...................... 1,986,694 191,879 404,022 391,944 998,849

Computer equipment and furniture and

fixtures ........................... 332,153 164,648 167,505 0 0

0.25% Convertible Senior Notes, including

interest ............................... 1,157,188 2,875 1,154,313 0 0

Financing obligation—building in progress—

leased facility .......................... 334,047 16,877 42,658 44,435 230,077

Contractual commitments .................. 25,177 11,702 7,263 5,964 248

$4,393,670 $506,801 $2,013,809 $643,886 $1,229,174

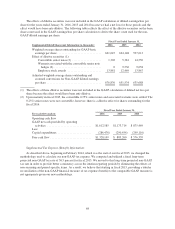

The majority of our operating lease agreements provide us with the option to renew. Our future operating

lease obligations would change if we exercised these options and if we entered into additional operating lease

agreements as we expand our operations. The financing obligation above represents the total obligation for our

lease of approximately 445,000 rentable square feet of office space in San Francisco, California. As of

January 31, 2016, $196.7 million of the total obligation noted above was recorded to financing obligation,

building in progress—leased facility, which is included in “Other noncurrent liabilities” on the consolidated

balance sheets.

In April 2014, we entered into an office lease agreement to lease approximately 732,000 rentable square feet

of an office building located in San Francisco, California that is under construction. The lease payments

associated with the lease will be approximately $590.0 million over the 15.5 year term of the lease, beginning in

our first quarter of fiscal 2018, which is reflected above under Operating Leases.

In February 2016, we entered into an agreement to sublease additional office space. The amounts associated

with the agreement will be approximately $311.0 million over the approximately 12 year term of the agreement,

beginning in the first quarter of fiscal 2018.

During fiscal 2016 and in future fiscal years, we have made and expect to continue to make additional

investments in our infrastructure to scale our operations and increase productivity. We plan to upgrade or replace

various internal systems to scale with the overall growth of the Company. Additionally, we expect capital

expenditures to be higher in absolute dollars and remain consistent as a percentage of total revenues in future

periods as a result of continued office build-outs, other leasehold improvements and data center investments.

In the future, we may enter into arrangements to acquire or invest in complementary businesses or joint

ventures, services and technologies, and intellectual property rights. We may be required to seek additional

equity or debt financing. Additional funds may not be available on terms favorable to us or at all.

We believe our existing cash, cash equivalents and short-term marketable securities and cash provided by

operating activities will be sufficient to meet our working capital, capital expenditure and debt repayment needs

over the next 12 months.

62